May 26, 2021

Overview

Many see balancing the world’s energy resources with a broader alternative mix as a critical element of limiting the impact of climate change. Although the change to greener energy sources cannot be done at the “flick of a switch,” it is, however, an energy transition that’s already underway.

The transition is being driven in part by the world’s governments. In its 2030 climate and energy framework, the European Union, for example, has directed member countries to reduce greenhouse gas emissions by 40 percent from 1990 levels by 2030 and use renewable sources to fulfill 32 percent of its energy demand by that time.

In the U.S., meanwhile, the White House has announced a target to reduce U.S. emissions by up to 52 percent below 2005 levels by 2030.

Beyond government measures, investors and consumers are advocating for change to cleaner energy sources as well — all of which can have a significant impact on an organization’s reputation and its ability to raise capital. In fact, a 2020 report found that 87 percent of global investors believe climate change has an impact on their portfolios and are increasingly interested in renewable energy sources.

A strong narrative will be a critical element for companies because they need to demonstrate to their stakeholders progress toward lowering their carbon footprint, says Patty Errico, head of global public affairs at Aon.

“Climate change is one of the most important global, long-tail risks this generation has faced,” says Errico. “Addressing sustainability and resiliency is a must. If a business has not yet been asked by an investor, shareholder, employee or customer how they plan to lower their carbon footprint and invest in a more sustainable future, it is coming.”

In Depth

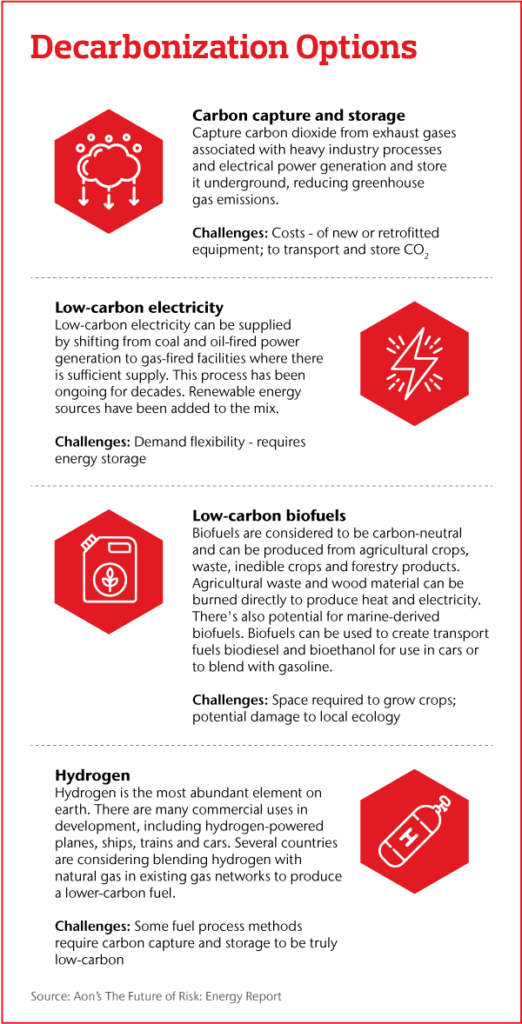

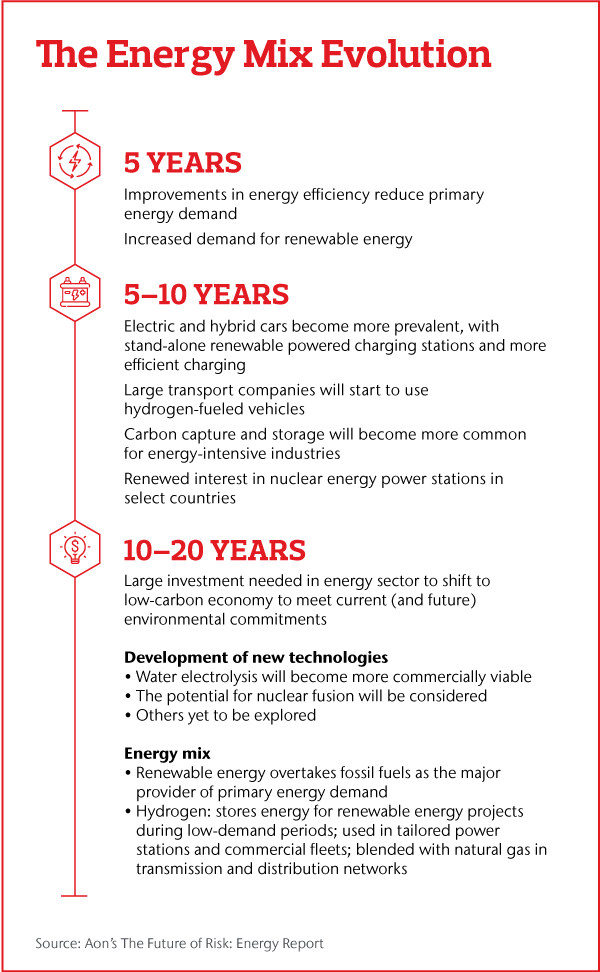

The energy transition will involve a variety of technologies, including renewables such as solar and wind and emerging alternatives such as hydrogen and carbon capture.

This transition is gaining momentum, helped along by two main factors. First, economic, social and regulatory pressures are making sure that renewable energy sources play an important part in meeting future energy demand. Meanwhile, advances in technology and the economies of scale gained from broader renewable energy adoption will make those green energy sources more affordable, further accelerating the transition.

“We are not witnessing an early demise of the fossil-fuel economy,” says Euan Nicolson, global chief commercial officer for Aon Energy. “Oil and gas products will likely remain an important commodity with many critical applications for the global economy up to 2050, and even beyond. However, we will undoubtedly see an increasing transition from their use as a largely disposable commodity with a high carbon footprint to a significantly lower carbon intensity, trending to a circular economy, supported by new and sustainable technologies.”

The Pressures for Change

Against that backdrop, many businesses are focused on reducing their carbon footprint as their stakeholders are demanding it.

“Businesses are thinking, ‘How are we going to attract continued investment in our company if we can’t demonstrate an improving carbon footprint?’” says James Stretton, broking director at Aon Energy. “It’s going to be difficult to deliver net-zero next year, but if you can’t demonstrate commitment and a credible plan of action over the next five to 10 years, securing investment will become more challenging.”

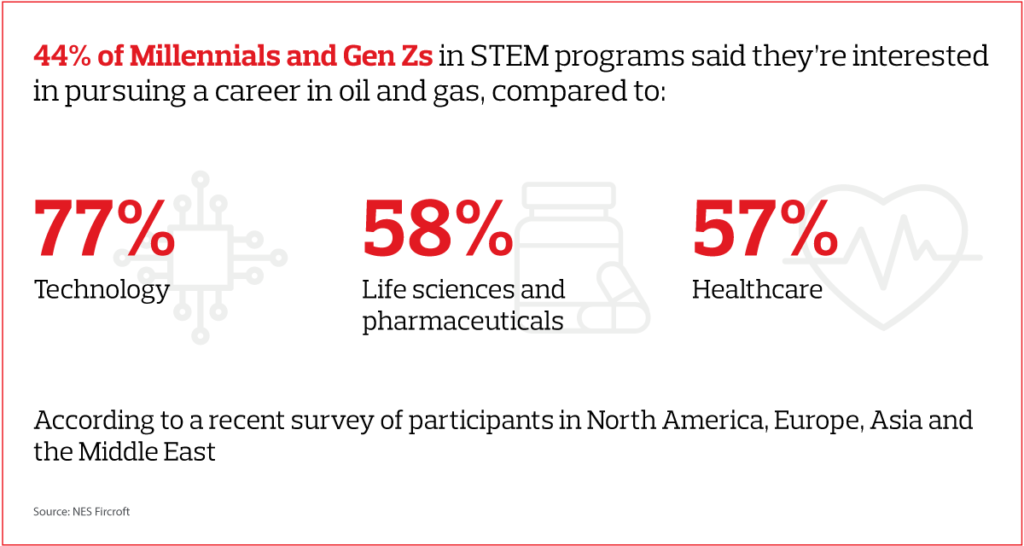

While the energy transition touches all industries, oil companies may feel the impacts first. To evolve, many major oil companies are starting to reposition themselves as integrated energy companies — leaning more heavily into renewables, natural gas and hydrogen — with the goal of being carbon neutral by 2050. And this repositioning might also be key to attracting and retaining top talent, a challenge given cross-industry competition, and growing global focus on climate change.

“It’s becoming increasingly more difficult to attract the best graduates globally to fossil fuel enterprises,” says Stretton. “To attract the best talent, companies will need to show that they’re diversifying — otherwise they risk a future skills gap.”

Governments are also driving the energy transition. Around the globe, governments are using regulations and setting targets aimed at reducing carbon dioxide emissions and increasing the use of renewable energy.

In the U.S., the new administration is focused on addressing climate change. In February, the U.S. Department of Energy announced up to $100 million in funding for transformative clean energy research and development. The administration has set a goal of investing $400 billion over 10 years in clean energy and innovation.

And in November 2021, Italy and the U.K. will host the UN Climate Change Conference, COP26. One of COP26’s goals is to finalize rules for carrying out the Paris Agreement and accelerate action to tackle the climate crisis through collaboration among governments, businesses and civil society.

Striking the Right Balance

Around 80 percent of global fuel demand is currently provided by fossil fuels, and energy demand is rising with population growth and economic development. Using greener fuels and carbon-reducing technology will mean an overhaul of the entire energy value chain: building new infrastructure, retrofitting or repurposing existing equipment and designing new transportation methods. It will be costly and take time.

For example, BloombergNEF estimates hydrogen could meet up to 24 percent of global energy needs by 2050. To get there, with strong and comprehensive policy in place, it would take more than $11 trillion of investment in production, storage and transport infrastructure. Annual hydrogen sales would be $700 billion, with billions more in end equipment costs.

“Many companies want to do right by the world, but they’ve also got shareholders with return-on-capital expectations,” says Stretton. “They therefore need to balance moving to new energy sources while making a profit, and that is a difficult challenge for many of the new technologies.”

That’s leading many to wait for public policy from large blocs such as the European Union or the U.S. to drive their actions, says Robert Colver, energy risk engineer at Aon. Those policies could involve incentives for businesses that develop or choose cleaner energy sources, or increasing the cost of using fossil fuels with taxes on carbon emissions.

For example, the European Union has announced a 14-billion-euro fund to support investments in generating and using energy from renewable resources. And in early 2020, the U.K. announced, as part of a larger £500 million innovation fund, £28 million in funding for five projects focused on hydrogen production.

Energy Transition in the Marine Industry

The marine industry is becoming a case study for the energy transition. The International Maritime Organization (IMO) has put forward a greenhouse gas strategy that sets a target for ocean-going shipping to reduce its carbon dioxide emissions by at least 40 percent by 2030 and by at least 50 percent by 2050, compared to 2008 levels. In January 2020, the IMO also adopted new limits on the sulfur content in ships’ fuel oil.

According to Chris Bhatt, chief commercial officer, Global Marine, at Aon, that leaves international shipping companies with three options: construct new vessels with cleaner engines, install scrubbers on engine exhausts or run on cleaner fuel. “It’s interesting because the legislation has prompted a huge increase in conversations about what other fuels we could use,” says Bhatt.

While the maritime industry is traditionally slow to change, Bhatt anticipates incremental improvements. He cites examples such as coastal ferry fleets in Norway that run on electric power, recharging while they’re docked as passengers come aboard or disembark, or discussions of wind-powered vessels.

Making Progress in the Meantime

The energy transition needed to address climate change will be driven by governments, investors, communities and companies. Reaching the goals necessary to reduce climate change will require significant government involvement, but that shouldn’t mean business leaders take a “wait and see” approach.

“Government action aside, we know that a sustainable business will have a plan for long-term resilience,” says Corey Green, director and global operations leader for Global Risk Consulting at Aon. “Consider the ways your company is contributing to climate change, both directly and indirectly, and then think about the parts of the balance sheet that may also be impacted by climate change. Having a plan to address these two perspectives or the discussion is the first step in the process.”

Learn more about Aon’s own commitments to environmental, social and governance issues – like achieving net-zero emissions by 2030 –- in the 2020 Aon Impact Report.

The post How Energy Transition Can Help Tackle Climate Change appeared first on The One Brief.