August 26, 2020

OVERVIEW

The novel coronavirus (COVID-19) pandemic has affected every aspect of life and business. But as organizations focus on the immediate impact of the pandemic, they might be taking their eyes off the implications for their intangible assets.

During the past several decades there’s been a dramatic rotational shift in the source of businesses’ value. Intangible assets — which include a company’s intellectual property (IP), such as copyrights, know-how, patents, trademarks and trade secrets – represent nearly 85 percent of the value of the S&P 500, or $19 trillion, during

fiscal year 2020. It’s a complete shift since 1975, when the S&P value attributed to intangibles was merely 15 percent.

Notably, the 45 years since 1975 have endured five recessions, not including the current economic downturn caused by the pandemic.

“The IP asset class typically does very well in recessionary times,” said Lewis Lee, CEO and global head of Intellectual Property Solutions at Aon.

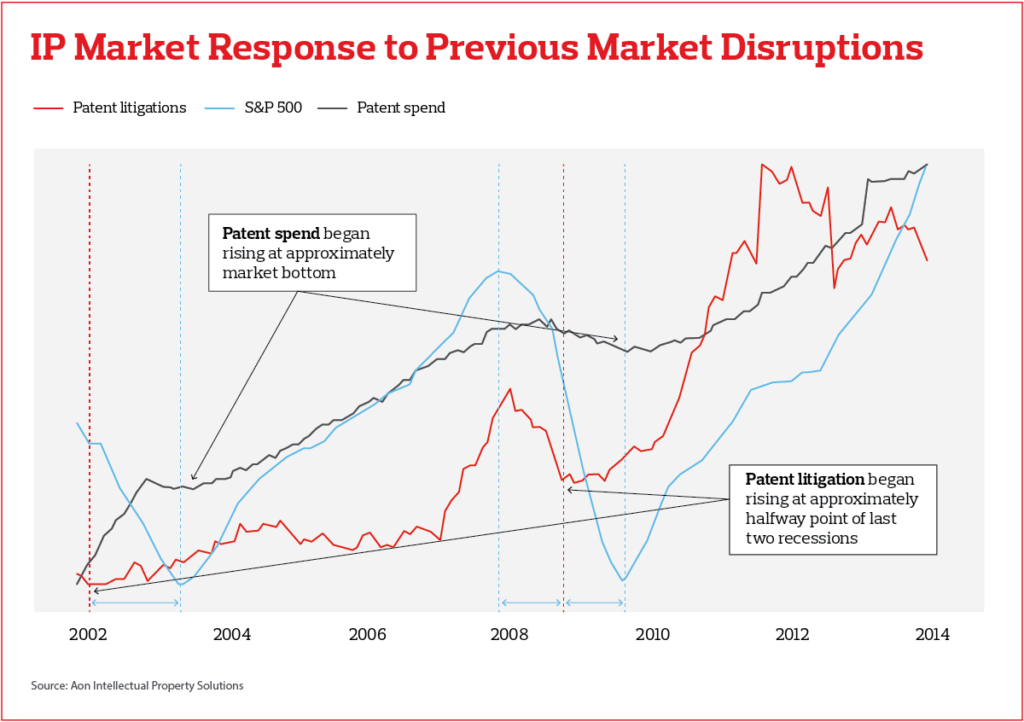

One particular reason is that crises can lead to the creation of new IP, as companies develop creative solutions for tough times. Historical trends show spending on patents tends to rise when the market hits bottom. Companies may try to maximize value from their existing IP portfolio to explore new ways to increase enterprise value overall.

“Crisis drives innovation by forcing behavioral changes,” says Lee. “Conditions are forcing us to change our behaviors, and as a result there will be tremendous innovations to serve the new normal. On the downside, risks like IP liability and trade secret theft may ride the same wave.”

IN DEPTH

In a distressed economy, companies typically have four major responses. And IP plays a role in each:

Conserve cash:

Cash considerations tend to focus on cost management. A company’s IP portfolio can be an opportunity to find savings. By assessing the costs and quality of their IP portfolios, businesses may be able to identify areas where they can prune, sell and carve out assets as appropriate.

“A solid IP analytics approach can help identify such IP assets to optimize quality and coverage while focusing on decreasing overall cost,” says Brian Hinman, chief innovation officer, Intellectual Property Solutions at Aon.

For many organizations, monetizing existing IP can be a way to gain needed cash. That can take the form of IP licensing, selling IP or IP enforcement.

Hunt for capital:

As companies wrestle with liquidity issues in a crisis, they might look toward alternative capital sources. Those might include IP-backed financing opportunities, monetization of future royalty streams and IP licensing programs.

Protect balance sheets:

Given IP’s increased role in determining most organizations’ overall value, securing and protecting those assets is essential. IP litigation can be expensive and IP losses can have a significant impact on organizations’ value.

The value of intellectual property is probably not stated in a company’s balance sheets, because

accounting conventions limit the situations in which these assets can be recorded, Hinman says. Instead, they are likely to be reflected in the market value of a company’s shares, as long as investors are cognizant of a firm’s IP.

“IP value can be significant for a company and should be adequately protected,” says Hinman. “Being able to effectively assess the risk of third-party IP liability claims is essential as companies conduct their operating businesses.”

Risks to consider here include supply chain and vendor viability, IP infringement, and employee trade secret theft and misappropriation. Another important factor to bear in mind is that IP-related litigation tends to increase in recessionary times.

Because many employees have been forced to work remotely due to the COVID-19 pandemic, a company’s IP faces an increased risk of cyber attacks and trade secret theft. In some cases, employees working remotely might be storing IP on personal devices or sending it over unsecure internet connections. As companies innovate in response to the pandemic, they must protect the IP they’re creating as well as existing assets.

“With the displaced workforce, trade secret theft is going to be on the rise,” says Lee. “People are going to be leaving their positions or there’s going to be turnover, and many are working from home.”

A trade secret registry can help organizations manage the risk by allowing them to identify, catalog and register their trade secrets, and manage access to them. “Such a registry can also support insurance for trade secret theft. It demonstrates that the company can show evidence of creation of its trade secrets and reflect reasonable measures that the company undertakes in protecting these critical assets,” says Hinman.

Reimagine their future:

In the midst of a crisis, organizations will need to reexamine key initiatives, consider changes in the mix of products and services offered, or look for opportunities for mergers and acquisitions or IP asset acquisitions. “Once again, a solid IP analytics approach here can help identify and assess quality and value of IP for such transactions,” says Hinman.

IP plays a vital role in an organization’s efforts to position itself for the future as a crisis prompts it to reevaluate its business.

Accelerating Innovation

“You’ve heard the adage, `Never waste a good crisis,’ ” says Lee. “Many companies use crises to decide they’re going to change course. That typically means you’ll start to see innovation pick up pretty heavily in a downward cycle and then continue through the bottom because companies start to reimagine and reinvent themselves.”

As COVID-19 changes the way we live and work, the pace of innovation will increase, as businesses come forward with developments that help us manage the everyday changes the pandemic has caused.

We’re seeing these outputs already: medical devices reimagined to protect doctors and nurses as they care for coronavirus patients, high-tech mobile “sticks” fitted with cameras that safely connect coronavirus hospital patients with their families, algorithms and equipment for contact tracing efforts, and use of drones to provide indoor disinfection.

With each innovation, the value of IP grows.

Understanding IP’s Value

Taking advantage of IP in a crisis requires understanding the value of the organization’s copyrights, patents, trademarks and trade secrets, including the impact new innovations might have on its overall portfolio.

“As they look at how they might get value out of their IP, how they might use it to leverage financing, some companies are struggling to understand their IP value and what they have,” says Lee.

Understanding the value of IP is also critical to protecting it adequately. Failure to recognize the real worth of IP could mean companies caught up in patent or trademark litigation could lose out.

In addition, companies looking to restructure during the crisis must have an accurate view of the value of their intellectual property if their revamp is to be successful.

As The Crisis Prompts Innovation, IP Can Help Businesses

As innovations emerge in response to the novel coronavirus pandemic, the value and amount of companies’ IP will increase. While existing IP can be critically important in helping companies manage through the pandemic, the IP they develop in response to the crisis will help shape their futures.

“Once you’re able to assess your IP and get a really good baseline of it and understand its quality, competitive juxtaposition and the trends, you can use it to do all sorts of things strategy-wise, risk-wise, capital markets-wise, lending-wise,” says Lee. “As businesses begin to identify and seize opportunities, it’s critical that they understand the value of the IP they’re creating — and anticipate and mitigate IP risks that are on the rise with the pandemic and downturned economy.”

This document has been provided as an informational resource for Aon clients and business partners. It is intended to provide general guidance on potential exposures and is not intended to provide medical advice or address medical concerns or specific risk circumstances. Information given in this document is of a general nature, and Aon cannot be held liable for the guidance provided. We strongly encourage readers to seek additional safety, medical and epidemiological information from credible sources such as the World Health Organization. As regards insurance coverage questions, whether coverage applies or a policy will respond to any risk or circumstance is subject to the specific terms and conditions of the insurance policies and contracts at issue and the relevant underwriter determinations.

While care has been taken in the production of this document, and the information contained within it has been obtained from sources that Aon believes to be reliable, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the report or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication.

The post How Crisis Sparks Innovation: Intellectual Property In Distressed Markets appeared first on The One Brief.