OVERVIEW

When people think of natural disasters, earthquakes or hurricanes usually come to mind. But the bushfires in Australia and a volcanic eruption in the Philippines remind us that a host of other natural events can also have catastrophic consequences for communities and businesses.

Floods, fires, droughts, tornadoes, windstorms and hail can threaten lives, damage communities and even have ripple effects around the globe.

“The biggest takeaway from the last decade related to natural disasters was the emergence of previously considered ‘secondary’ perils – such as wildfire, flood and drought – becoming much more devastating and costly,” says Steve Bowen, director and meteorologist with Aon’s Impact Forecasting Team. “Scientific research indicates that changing climate patterns will continue to affect all types of weather phenomena and subsequently impact increasingly urbanized areas.”

More than 400 natural catastrophes in 2019 resulted in an estimated $232 billion in economic damages. These disasters include fires in Australia and Russia (that together burned nearly 30 million hectares of forest) and monsoon floods in India, which were the year’s deadliest disaster (causing 1,750 fatalities).

Notably, less than a third of those damages – only $71 billion – was covered by private or government-sponsored insurance programs, further demonstrating the global protection gap.

Socioeconomic forces, compounded by the impact of climate change, has put more individuals and property at risk of natural disasters. Government–business partnerships to build disaster resilience through risk mitigation and risk transfer are therefore becoming a necessity.

IN DEPTH

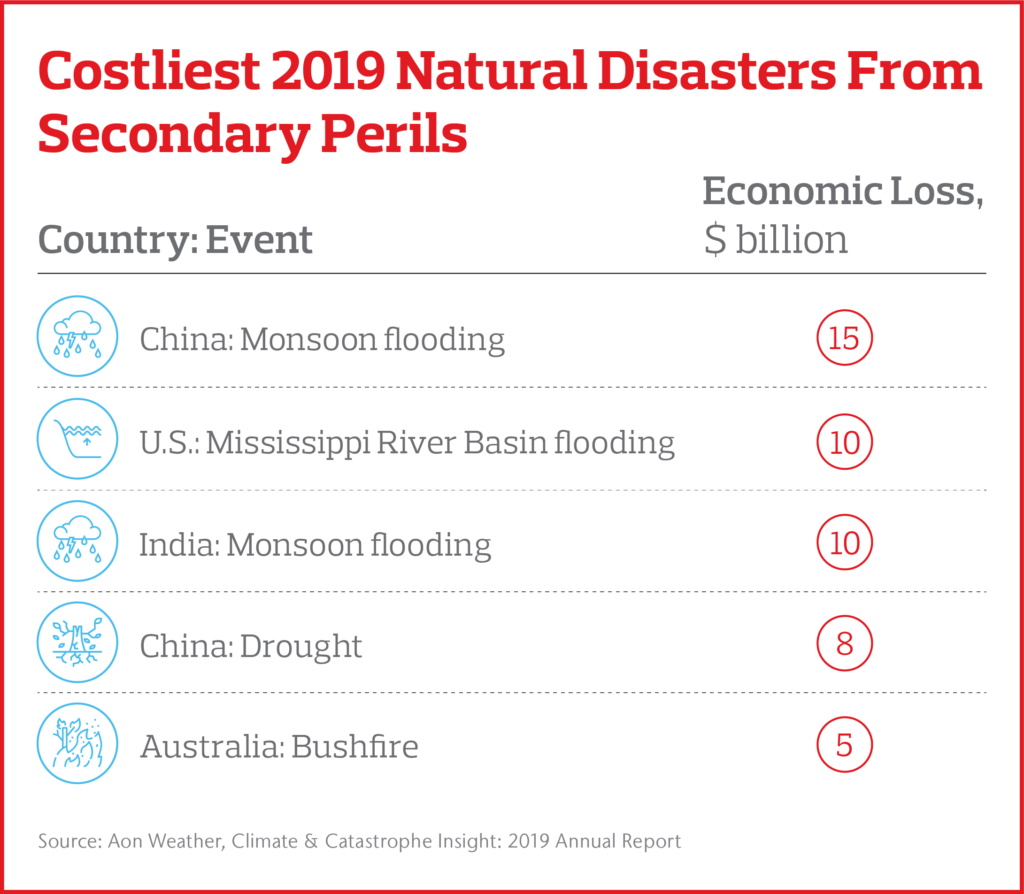

Together, the world’s natural disasters were responsible for more than 10,000 fatalities in 2019. Cyclones were prominent among 2019’s most expensive natural disasters. Yet Aon’s 2019 Weather, Climate & Catastrophe Insight: 2019 Annual Report shows that other events – those that are known as “secondary perils” – also caused significant economic losses.

“Even in the case of a ‘primary peril’ like a hurricane, it’s the accompanying secondary type of impact beyond wind – such as coastal and inland flooding – that heightens the damage,” Bowen says.

Among the secondary perils that had massive consequences in 2019 was the heaviest monsoon rainfall to hit India in more than two decades. Beyond the massive loss of life, the consequent severe floods were 2019’s fourth-costliest natural disaster, with economic losses similar to those from Typhoon Lekima and Typhoon Faxai in eastern Asia and Hurricane Dorian in North America and the Caribbean.

Monsoon floods in China in June and July caused 300 deaths, and the wettest 12-month period on record in the contiguous U.S. caused floods in the Mississippi and Missouri River Basins during the spring and summer months.

Meanwhile, amid the most devastating floods were also costly droughts. Those in China lasted throughout the year; a multiyear drought, coupled with record-setting spring and summer heat, caused bushfires in Australia that have burned 46.3 million acres and destroyed 2,700 homes to date.

The High Cost Of Secondary Perils

Inland floods were 2019’s costliest peril globally, causing $82 billion in losses – the most since 2016. The flood events in China, India, Iran and the U.S. led to more than $53 billion in combined economic impact. Meanwhile, 2019 droughts led to $23 billion in losses.

Severe convective storms – tornadoes, straight-line winds, hailstorms and lightning storms – are growing in both frequency and cost. Indeed, insurance payouts for these types of storms, largely for wind and hail damage in the U.S., have topped $20 billion for the fourth consecutive year since 2016.

“Severe convective storms are certainly a concern. Hail has caused major damage to large commercial buildings, not just homes. And, surprisingly, tornadoes have occurred in every state in the country,” says Mike Panfil, managing director of Property Risk Control at Aon. “Obviously, the area of impact of these storms is not as widespread as hurricanes, but they can be devastating. Properties are generally not built to withstand tornadoes, and there is little time to prepare, such as by shutting down operations.”

Minding The Protection Gap

The 2019 protection gap (the portion of natural disaster losses not covered by insurance) – was at 69 percent – its fifth-lowest level since 2000 but still up from 2018’s 61 percent.

The gap widened in part because many of the costliest events occurred in emerging economies (such as China, India and Iran), where insurance is more sparse than in mature economies (in the U.S. alone, for example, natural disasters accounted for more than half of insurance payouts in 2019).

Over the past decade in Asia, insurance covered just 12 percent of some $1.24 trillion in economic losses due to natural disasters. Major protection gaps also exist in Latin America and Africa.

The protection gap means that much of the natural disaster recovery effort likely falls on governments or international financial sources. But new risk transfer tools such as parametric insurance – which bases coverage on an agreed-upon triggering event rather than a pure loss – risk pools and catastrophe bonds can help improve insurance protection in underinsured areas.

To Keep Up With Natural Perils, Resilience Must Be A Priority

As the risks of all types of natural perils become more frequent, so does the potential for losses. In such an environment, finding ways to reduce risks and build resilience is essential.

“The potential financial costs of natural perils are only going to increase,” says Bowen. “The most buzzworthy topics in 2019 surrounded resilience and how private-sector groups are incorporating new technologies via artificial intelligence to create new solutions that solve problems – before they occur.”

The post Beyond Quakes And Storms: Why Plan For Fires, Floods and Droughts appeared first on The One Brief.