OVERVIEW

The amount of debt carried has always been of concern to economists, governments and sociologists. The link between amounts owed and their impact on a country’s society and financial health is well known. Yet the shockwaves of excessive borrowing are being felt in another crucial part of the broader economy: the workplace.

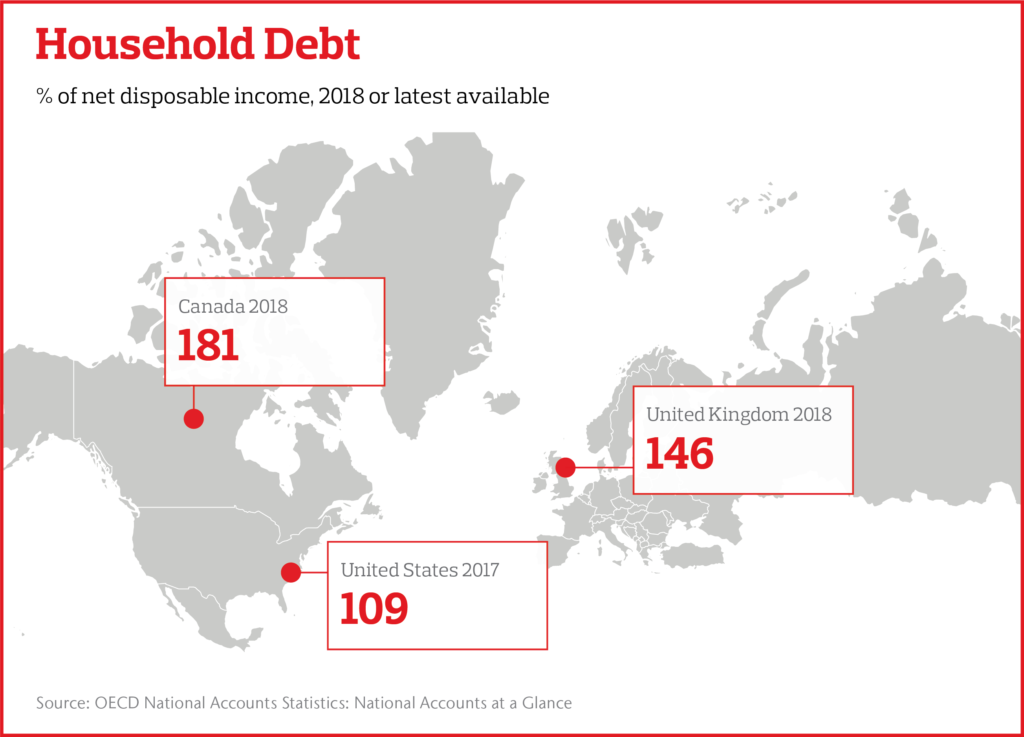

Around the world, personal borrowing is on the rise. In the U.S. it reached $13.86 trillion in the second quarter of 2019 – more than $1 trillion higher than leading up to the 2008 financial crisis. That’s the equivalent of 109 percent of net disposable income per household. Nearly half of workers in the U.S. carry credit card debt they can’t pay off each month, according to Aon’s 2018 DC and Financial Wellbeing Global Employee Survey.

And the U.S. isn’t alone. In Canada, total household debt stood at C$2.25 trillion ($1.7 trillion) in the second quarter of 2019, or 181 percent of net disposable income per household. In the U.K., household debt – excluding mortgages – reached a new high of £428 billion ($550 billion) in 2018, or 146 percent of net disposable income per household.

Major sources of personal debt include mortgages, student loans, credit cards and medical bills. “Whatever the source, such financial burdens affect an individual’s health and possibly even workplace performance,” says Lori Goltermann, chief executive officer of Aon’s U.S. risk and health solutions business.

A recent study of millennials – a generation doubly impacted by both the 2008 financial crisis and high student loan debt – found a correlation between the stress brought on by personal finances and their overall health. Those financial worries can creep into the workplace in the form of increased employee stress, inability to focus and increased absenteeism and tardiness, hampering overall workplace performance.

While clear connections between finances and health exist, one disconnect remains: perceived personal financial situation and reality. “Most people say they are confident about their current financial situation,” says Melissa Elbert, partner at Aon. “In reality, however, an overwhelming number of people are just getting by financially. Bigger picture: over the long-term, many of today’s workers will have to wait longer to retire than previous generations – if they can retire at all.”

Given the overlap between financial preparedness and health, employers are looking to help bridge the gap with their workers and place greater effort around their workforce’s financial wellbeing.

IN DEPTH

“Financial wellbeing – how comfortable and financially prepared someone is – is a key part of an individual’s overall wellbeing,” says Elbert. “It’s a person’s ability to confidently manage their financial life today while preparing for the future and anything unexpected along the way.”

Numerous sources of consumer debt, whether alone or in combination, can impact personal savings and an individual’s financial wellbeing.

Mortgages

Mortgage loans are typically the largest component of consumer debt. In the U.S., household mortgage debt stood at $9.8 trillion in the second quarter of 2019. In Canada, mortgage debt reached C$1.44 trillion in 2018. In the U.K., residential mortgage debt totaled more than £1.45 trillion in the first quarter of 2019.

Student Loan Debt

In many countries, student loan debt represents a significant portion of the total debt. The total U.S. levels far outpace the rest of the world: 44 million borrowers owe close to $1.5 trillion. Meanwhile, student loan debt in Canada totaled C$28 billion, with the average Canadian university graduate owing C$26,000. And in the U.K., the total value of outstanding student loans totaled £121 billion at the end of 2019’s first quarter; the average 2018 graduate is pegged to owe £36,000.

In many countries, student loan debt represents a significant portion of the total debt. The total U.S. levels far outpace the rest of the world: 44 million borrowers owe close to $1.5 trillion. Meanwhile, student loan debt in Canada totaled C$28 billion, with the average Canadian university graduate owing C$26,000. And in the U.K., the total value of outstanding student loans totaled £121 billion at the end of 2019’s first quarter; the average 2018 graduate is pegged to owe £36,000.

Credit Cards

Credit card debt is another factor affecting financial wellbeing. U.S. households ended 2018 with $870 billion in credit card debt, with the average American household carrying a balance of $5,700. U.K. credit card debt totaled £72.7 billion in June, with the average household bearing an average of £2,688 in credit card debt. Households in Canada had C$769.4 billion in consumer credit and non-mortgage loans at the end of 2018 and carried an average credit card balance of C$4,154.

Medical Expenses

Medical expenses can be another cause of debt – distinctly in the U.S.: $81 billion in outstanding medical bills. “The leading cause of bankruptcy for over half of Americans is medical debt,” Goltermann explains. In countries with single-payer national health care systems, such as Canada and the U.K., the situation is less stark, though some procedures remain uncovered or uninsured.

While the U.S. medical expense situation is the most pronounced, the connection to financial wellbeing and overall health can be considered similarly across the globe. From lack of sleep to stress to anxiety, financial woes can take a toll on one’s mental wellbeing even in the absence of mental illness. In the presence of mental illness, the connections are more acute: findings from the U.K.’s Money and Mental Health Policy Institute show that those with mental health challenges are three and one half times as likely to be in “problem debt.”

“All of these wellbeing factors are interwoven: workers worry about finances, which causes them stress, and overall health declines,” says Goltermann. “It is a vicious cycle.”

Debt’s Impact On Retirement

In addition to the toll that debt can take on one’s health today, that debt can also jeopardize retirement savings in the long term.

More than half of U.S. workers in their 20s and 30s are significantly below retirement savings targets, according to Aon’s The Real Deal: 2018 Retirement Income Adequacy report. The DC and Financial Wellbeing Global Survey also found that nearly one in 10 U.S. workers approaching retirement still have student loan debt, compared with one in 50 in Canada. And in the U.K., already burdened by student loan debt, younger workers will need even more money to retire than their older peers – this time because they are expected to live longer and medical inflation is expected to outpace wage growth.

Across geographies, longer life expectancies also mean that younger employees will be working later into traditional retirement years.

Approximately one-third of workers in the U.S. and Canada expect to “work forever” in some capacity, compared with one-fifth in the U.K., according to the DC and Financial Wellbeing Global Employee Survey. “Our research shows that retiring in your 70s – or not all – will become increasingly common,” says Elbert.

How Employers Can Encourage Employees’ Financial Wellbeing

Employers are increasingly recognizing the importance of addressing their employees’ financial wellbeing.

In fact, Aon’s 2018 Global Financial Wellbeing Study, fielded to 159 multinational organizations, showed that close to 66 percent would have a global financial wellbeing strategy in place within the next three years. A full 95 percent of respondents see “reducing employee financially related worries and stress” as a key objective of financial wellbeing programs.

Given the diversity of employees, financial wellbeing programs may require providing employees a broad range of tools and resources across a variety of financial topics. “Generally, younger workers will be concerned about student loans and home buying,” says Grace Lattyak, partner at Aon. “Middle-aged workers may focus on savings for their children’s education.”

Recognizing the significance of student loan debt, some employers are considering programs aimed at helping employees better address those financial obligations, including flexibility to reallocate their defined contribution or trading paid time off for funds toward paying down student loans.

“Benefits, such as student loan repayment, can be considered part of talent acquisition strategies – especially for younger talent. With a workforce in their 20s and early 30s carrying such large amounts of student loan debt, employer programs to alleviate the burden can be a real differentiator,” says Alex Bush, senior retirement consultant at Aon.

Regardless of the program, the goal is the same: help employees reduce their financial stress.

“The key is crafting – and iterating on – programs that best serve your employee base,” says Bush. The return on that investment may be a more financially savvy, retirement-ready workforce – which could lead to better health and productivity across an entire population.”

The post The Consumer Debt Crisis: A Vicious Circle Of Finances, Stress And Health appeared first on The One Brief.