OVERVIEW

Companies must navigate a series of external forces to do business wherever they operate. Political upheaval, civil unrest, trade disputes and terrorist attacks can each pose a significant threat, potentially preventing a company from operating successfully in volatile countries or regions.

Aon’s 2019 Risk Maps have identified key risks associated with threats facing businesses in various countries around the world, including civil unrest, political populism, trade wars, currency inconvertibility and the rise of far-right and national extremist terrorism.

In a complex and ever-changing geopolitical environment, businesses must address their exposure to political and terroristic risks to protect their employees, assets, supply chains, contracts and sometimes even the business itself.

In Depth

Trade wars, the impact of populist political movements, widespread civil unrest and other political risks can affect a company’s ability to operate in certain areas, threaten markets, disrupt supply chains or make it prohibitively expensive to do business.

On top of this, organizations must contend with evolving terrorism risks. In addition to human casualties, terrorist attacks can cause property damage, business interruption, reduced attraction of customers to the business and potential reputation damage and legal liability.

In Europe, Terrorism And Political Activism Create Security Issues

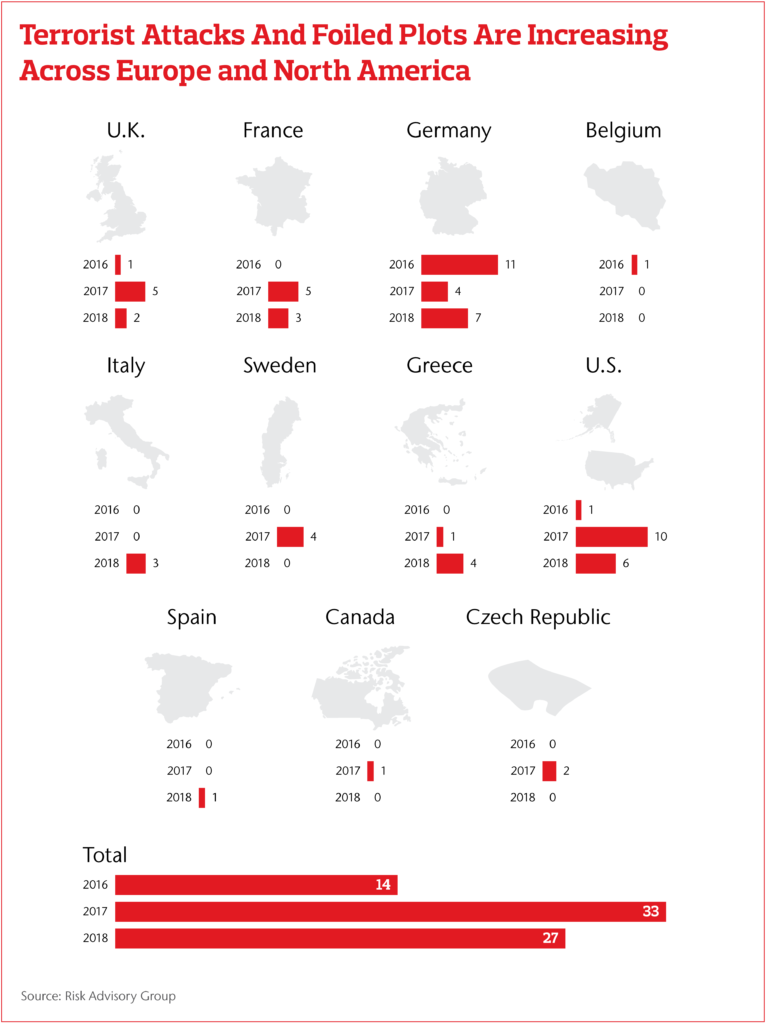

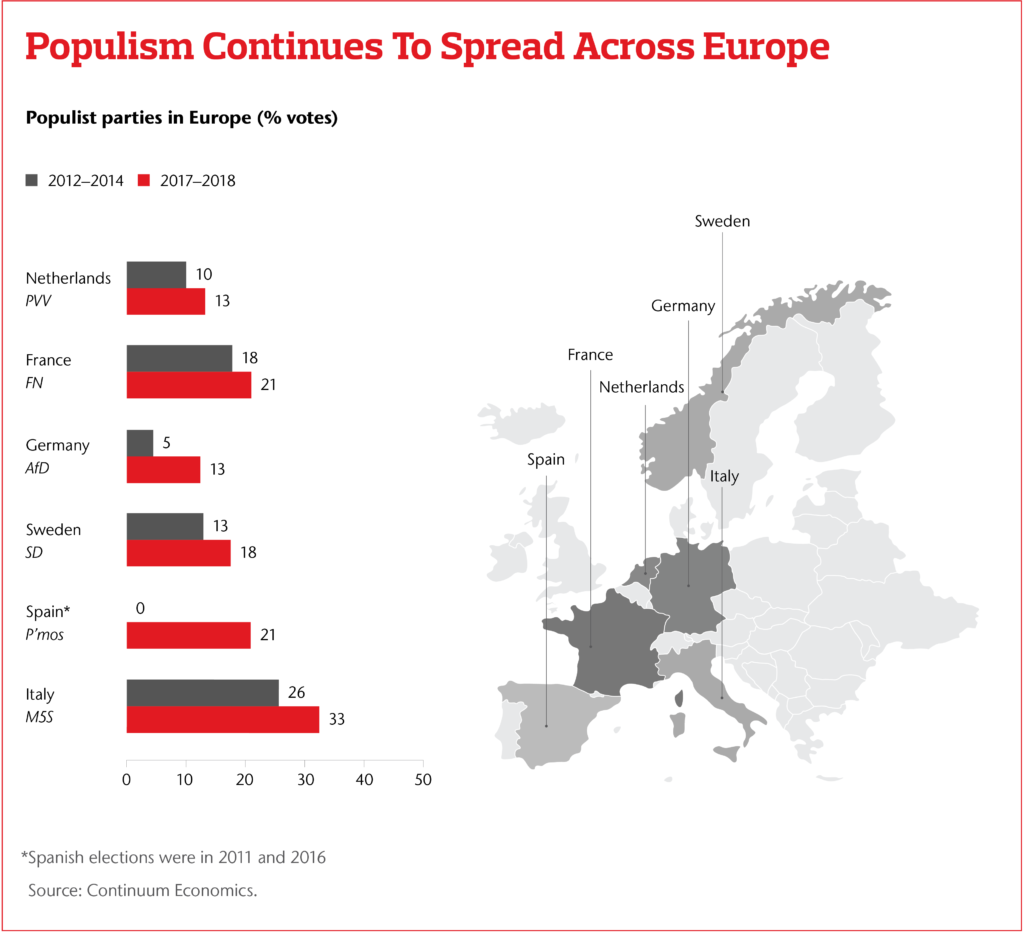

Aon’s 2019 Risk Maps show the combination of Islamist terrorism and far-right and national extremist terrorism is resulting in new security vulnerabilities for many businesses. Populist politics further complicate the environment for companies with European operations, prompting events such as the U.K.’s Brexit referendum, divisive policies in some countries and, in some cases, extreme ideologies.

While the risks associated with terrorism threaten the safety of employees and customers, issues associated with populist politics — such as trade barriers or tariffs — could harm businesses’ supply chains and investments.

Among the key European findings in this year’s Risk Maps:

• Terrorists are increasingly targeting public spaces and large concentrations of people. As such, 16 percent of terrorist attacks in Europe in 2018 directly affected businesses.

• Far-right terrorism and activism is increasing throughout Europe. For example, Germany experienced 23 far-right attacks and plots from 2016 to 2018.

• The return of citizens who fought for the Islamic State will pose significant security challenges.

• Populist parties are part of the government in 11 countries in Europe, with populist parties holding an average 22 percent share of the vote across 33 European countries.

Populist Politics, Tariffs Pose Risks For Businesses in the United States

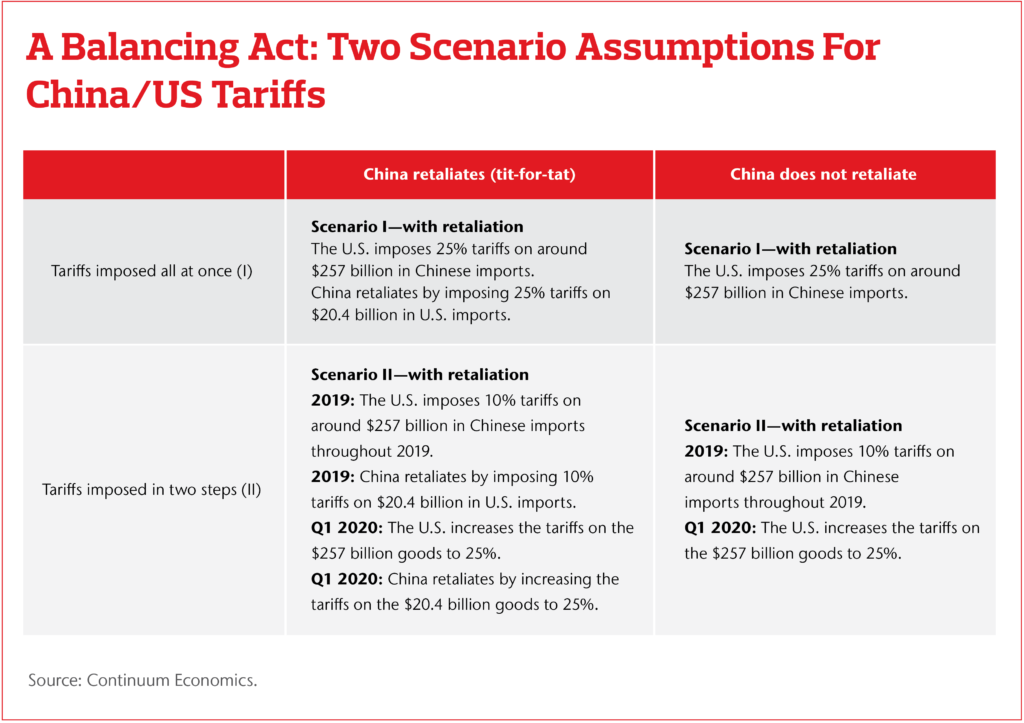

According to the Risk Maps, trade tensions between the U.S. and

China and political populism pose significant risks to businesses operating in

the U.S. in 2019. Furthermore, trade uncertainty and protectionism are risks in

many areas of the world, posing threats to supply chains and contracts.

“Political risks can manifest in many ways,” says John

Minor, U.S. national practice leader, Political Risk, at Aon. “An escalating

trade war, for example, could increase the cost of completing a project or contract

costs to the point of making it uneconomic, or force a company to rethink key

elements of its supply chain. In the most extreme circumstances, a trade war

could force some companies out of business.”

The

2019 Risk Maps also found that the U.S. ranked alongside Germany as having the

highest number of attacks and foiled extreme nationalist terrorist plots. Whether

they were referred to as hate crimes or terrorist events, these attacks were

not conducted on behalf of established groups.

“The rise of national extremist acts of violence, alongside concerns around Islamic State returnees, means that terrorism exposure within the U.S. is becoming more complex, leaving certain business and client types – retail, sports and entertainment, transport, religious sites for example – more vulnerable than others,” says Scott Bolton, director of Crisis Management at Aon.

China’s Belt and Road Initiative: Opportunities . . . And Risks

China’s multibillion-dollar Belt and Road Initiative (BRI) infrastructure

program offers tremendous business and investment opportunities. However, as

the 2019

Risk Maps reinforce, the regulatory and institutional frameworks of many of

the countries along the proposed BRI expose investors to significant risks,

including sovereign nonpayment, supply chain disruptions and political

interference.

Ultimately, however, the infrastructure investment from BRI

should create a positive “ripple effect,” particularly across emerging

economies in Southeast Asia and Africa, leading to increased investments across

supply chains, such as manufacturing hubs in free-trade zones.

Strikes, Civil Unrest And Terrorism Pose Significant Risks For Businesses In Sub-Saharan Africa

Businesses operating in more than two-thirds of sub-Saharan African countries are at risk of strikes, riots and other forms of civil unrest, while companies operating in a quarter of those countries face threats of sabotage and terrorism, according to the 2019 Risk Maps.

The political risks in the region aren’t necessarily connected to election cycles. “Investments seen as connected to governments are often the ones most at risk during these periods of unrest – with opposition groups targeting investments in strategic sectors to pressure sitting governments,” says Sarah Taylor, head of Political Risk and Structured Credit, Aon. “All these considerations must be considered by firms as they determine where, when and how to invest in the region.”

The Risk Maps show that some companies have been targeted with shutdowns, strikes and violence against workers and facilities. Beyond their immediate impact, such actions can threaten the viability of businesses and investments and increase the risk of supply chain disruptions.

“Businesses operating in the Mediterranean and sub-Saharan

African countries have been exposed to political violence for a number of years,”

says Bolton. “This is a broader risk than pure terrorism.”

Understanding The Risks, Making Better Decisions

In an increasingly global economy, it’s not uncommon for

companies to have operations, key markets or supply chain partners in far-flung

countries. Vlad Bobko, head of Crisis Management, Aon, underscores the value of

risk-related insights: “Understanding the political risk, violence and terrorist

threats in critical locations allows companies to identify potential

vulnerabilities.” This knowledge, he says, allows business leaders to address

exposures and make informed decisions around resource allocations and business

strategies. He continues, “These aren’t isolated to risk-management functions

alone. These are strategic decisions intended to progress the business forward

– especially in the midst of unknowns.”

The post Managing Volatility: The Search For Stability Amid Political Uncertainty And Evolving Terrorist Threats appeared first on The One Brief.