OVERVIEW

It used to be just older generations that worried about finding the money to pay for health care – not anymore. In fact, research shows that millennials are the most commonly affected generation by medical debt in the U.S.

And while the U.S. health care system is different than other countries around the world, medical costs are increasing worldwide. Further complicating the problem are factors such as longevity and declining health globally. People are struggling to prioritize their finances – so how can they save for retirement if they have medical bills to pay today?

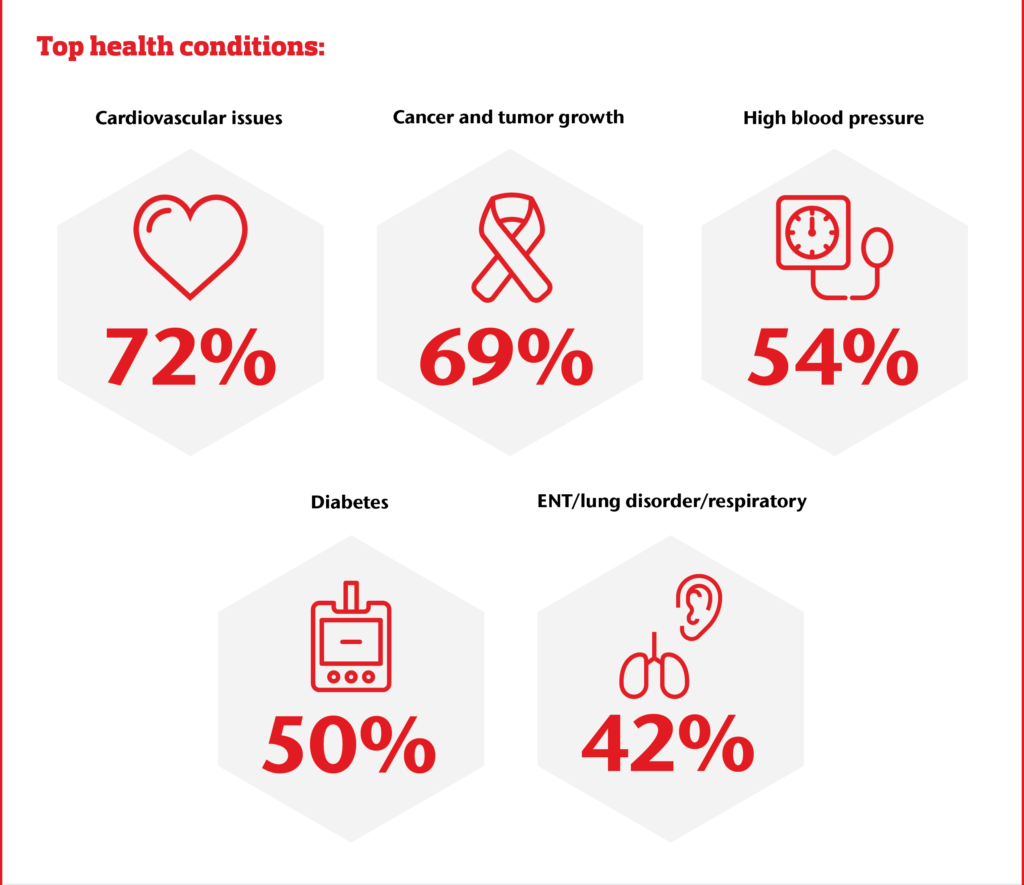

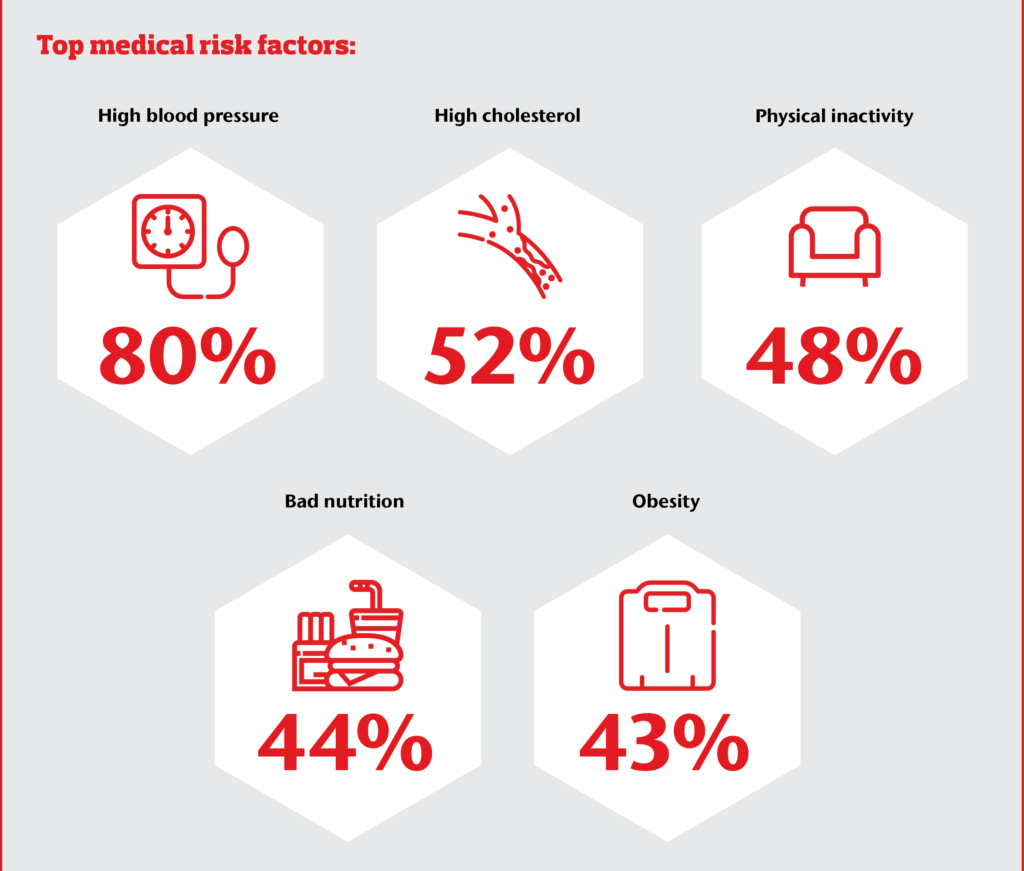

Perhaps not surprisingly, the reasons for increased health care costs and employer medical rates are just as complicated. According to Tim Nimmer, chief health care actuary at Aon, “An aging global population, declining health and poor lifestyle choices will likely lead to increased health care plan costs across the globe.”

However, employers have an opportunity to help combat these trends. Nimmer suggests that drilling into the data behind the costs themselves can give employers a clearer idea of what to prioritize.

In-Depth

According to Aon’s 2019 Global Medical Trend Rates Report, in the next 12 months the average employer medical-cost increase will be almost three times greater than the average rate of inflation. And medical rates will increase worldwide, exceeding their typical inflation levels by an average of nearly five percentage points.

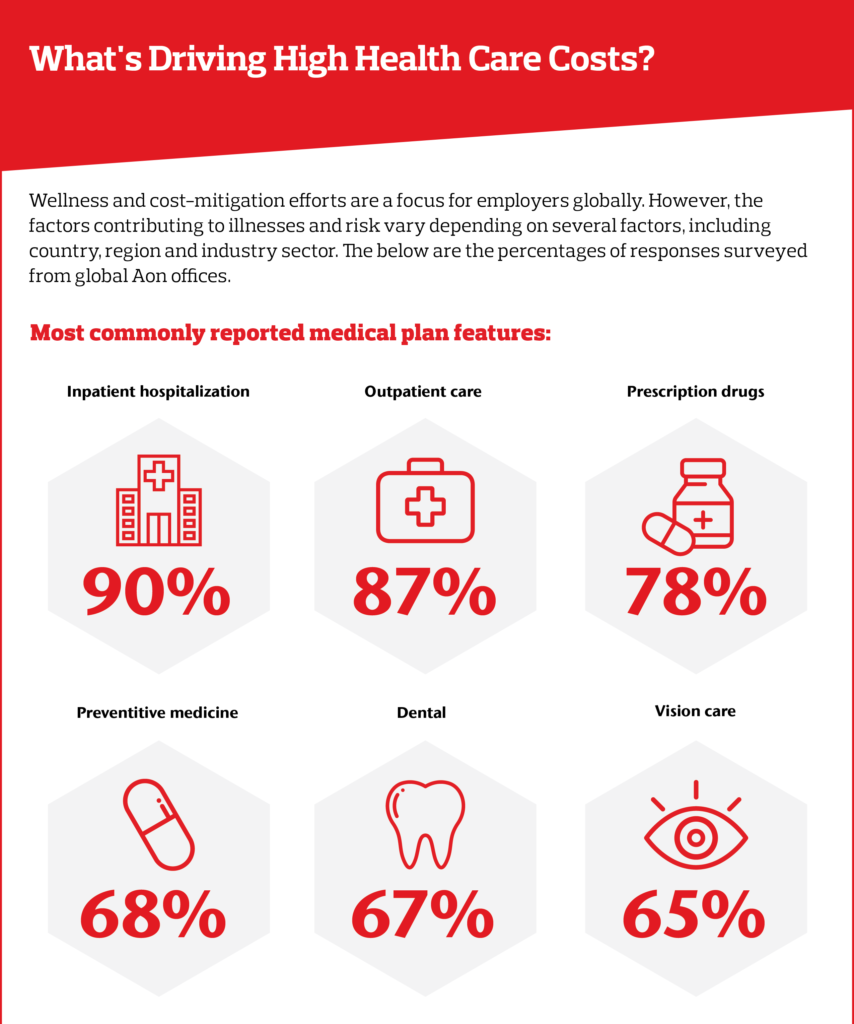

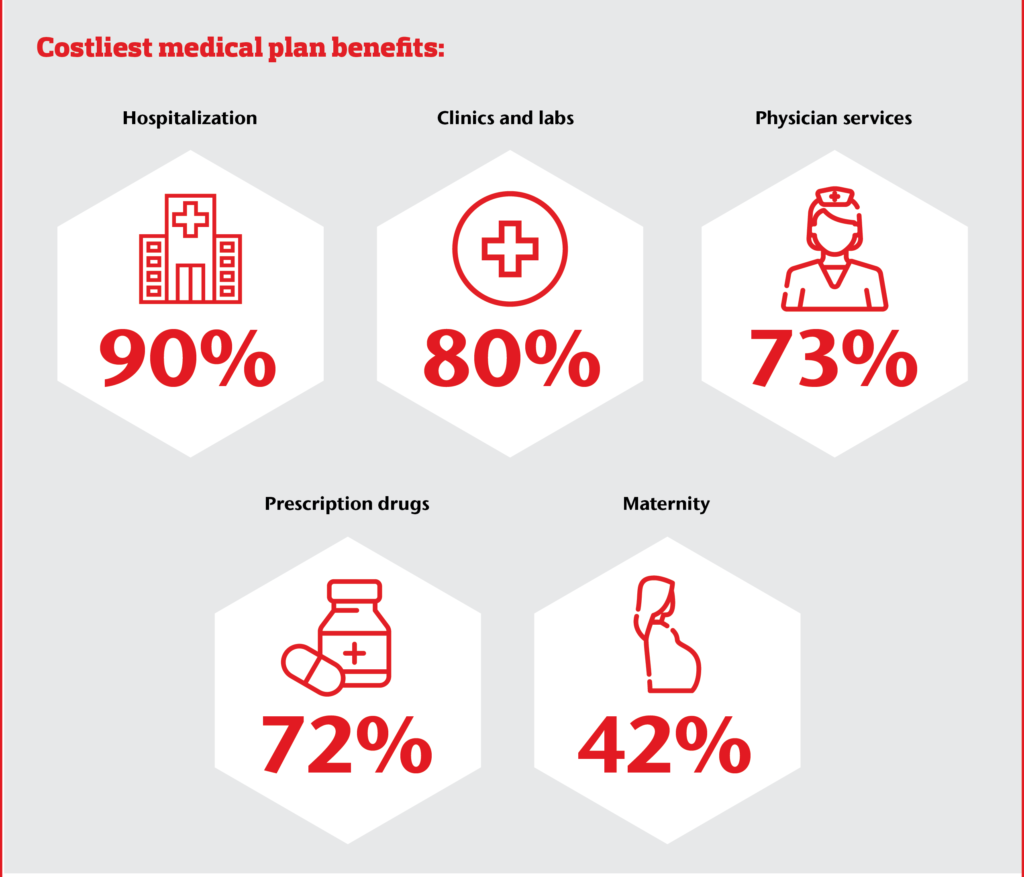

But while the increase in costs is global, the factors behind the rising costs differ from region to region.

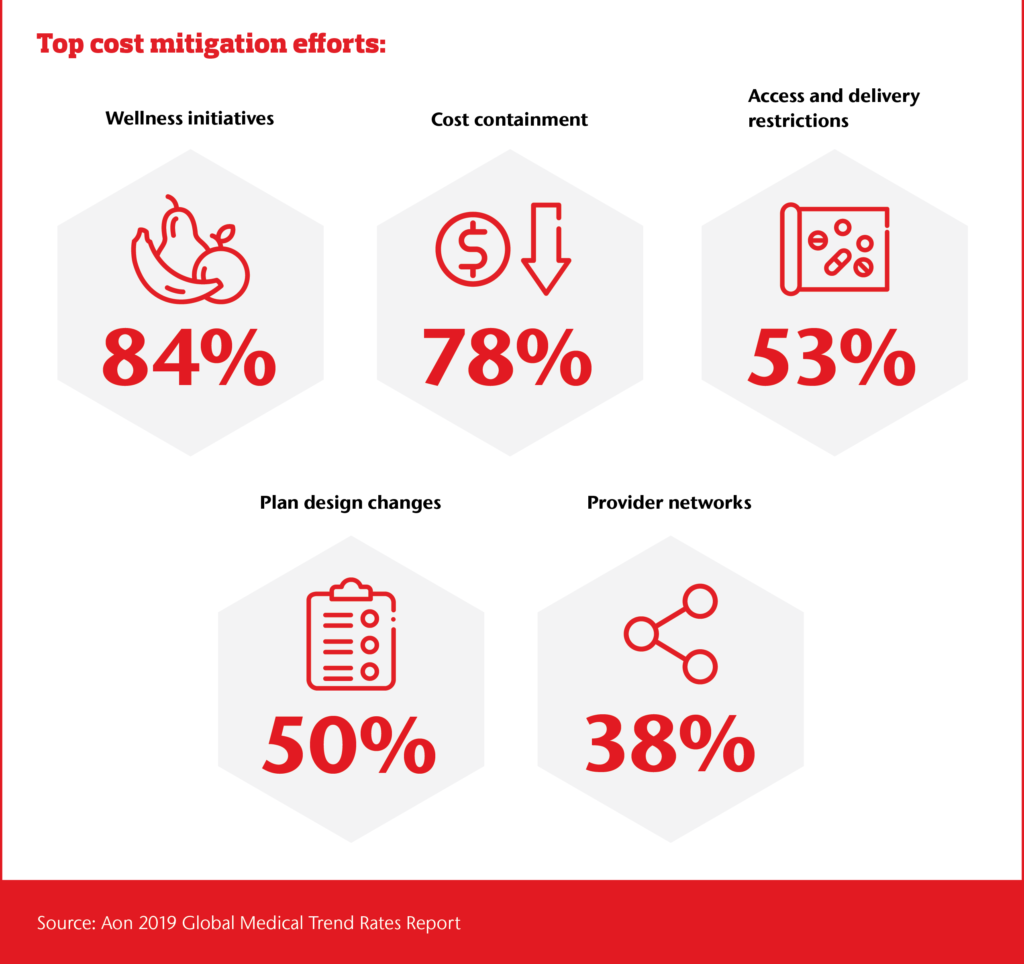

In the U.S., for example, medical costs are controlled partially by employers’ measures, such as cost-transparency tools, direct contracting with vendors, prescription drug alternatives and referrals to cost-effective providers. And in Canada, the federal government is attempting to control prescription drug costs by organizing the purchase of pharmaceutical products at a national, rather than provincial, level. These efforts likely helped North America achieve a relatively low regional gross average medical trend rate of 6.4 percent.

By contrast, the Middle East and Africa have a regional gross average medical trend rate of 13.7 percent. The United Arab Emirates’ higher health care costs, for example, are linked to more instances of chronic diseases – including cancer, hypertension and obesity – thanks to increased consumption of fast food coupled with progressively sedentary lifestyles.

So what’s driving these costs?

And while no single answer can solve the health care challenge, knowing which behaviors inflate medical plan costs can help determine the path forward. Nimmer states, “Whether helping an individual manage a chronic condition or investing in a health and wellbeing program, an employer can play a key role in helping decrease the costs associated with poor health by motivating and encouraging change.”

The post Modern Life Is Driving Health Care Costs Higher appeared first on The One Brief.