OVERVIEW

As growing climate risk increases the frequency and severity of natural disasters, shifting weather patterns are driving dramatic surges in another peril – wildfires.

Record wildfire losses over the last two years have posed a growing threat to people, property and business. “While wildfires have always occurred, the recent events in 2017 and 2018 have left costly impacts across urbanized areas at a scale not previously seen,” says Steve Bowen, director, meteorologist and head of Catastrophe Insight at Aon.

The amplified losses, he added, are changing the view on wildfire risk as a whole. “Because known fire locations are becoming increasingly urbanized, the vulnerabilities can lead to greater loss potential – to people, property and entire industries,” Bowen says.

And power companies are especially vulnerable and exposed to this peril. Recent years have seen the causes of wildfires in California, Texas, Australia and elsewhere linked to power lines, and utilities face significant liability exposures in some cases. “Natural disaster risks to the power industry aren’t new. However, the wildfire exposure is increasing and finding ways to transfer this risk will require creativity and innovative approaches,” says Mark Fishbaugh, U.S. Power Practice leader at Aon.

Many businesses confronting the growing wildfire threat have long-established strategies for mitigating other exposures. How do these companies adapt their risk management and resilience thinking in the face of a risk growing in severity?

IN DEPTH

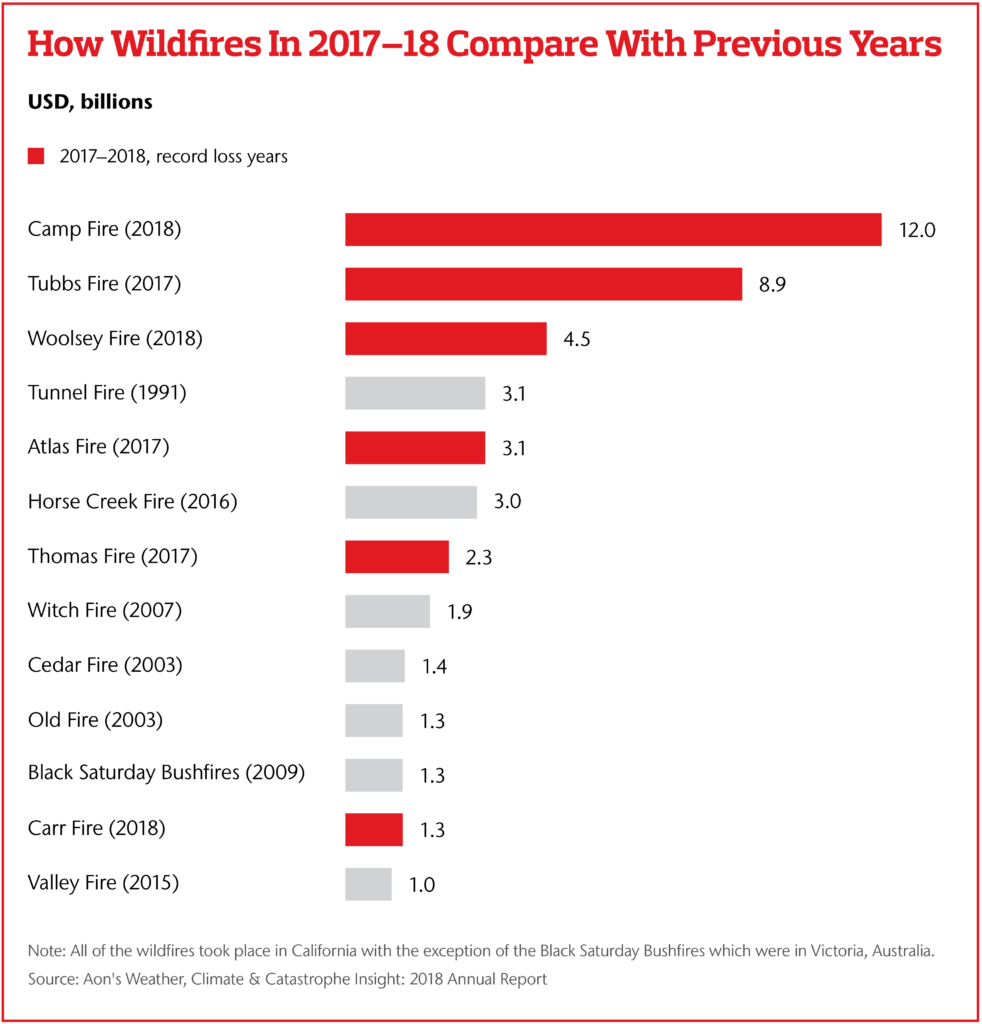

Of 13 historical billion-dollar-loss wildfire events, six occurred in 2017 and 2018. Global insured losses for catastrophic wildfire events hit a new record of nearly $20 billion in 2018, according to Aon estimates, with economic costs as high as $24 billion.

California’s 2018 Camp Fire was the costliest wildfire on record, causing approximately $12 billion in damages, destroying 18,804 structures and leaving 88 dead. The Woolsey and Carr fires that hit California the same year were also multibillion-dollar loss events.

Climate change and changing weather patterns suggest the wildfire risk will only continue to rise.

Weather Changes, Development Trends Increase Wildfire Exposures

Utilities in wildfire-exposed areas face greater risks as the areas become more developed.

For example, sparks from transmission lines can ignite dry vegetation, triggering enormous fires. “Massive disasters costing billions in damages can begin simply with dry ground, debris and a spark,” says Fishbaugh.

The issue is particularly acute in California, where the terrain and population growth on historically rural areas contribute to the threat. “Wildfires are not new, but the scope and scale of their damages due to these factors began to change how the insurance market views the risk,” Fishbaugh says.

Addressing The Growing Risk

Facility Design: Building For Resilience To Natural Disasters

The nature of power utilities and energy companies requires large investments in their facilities and infrastructure. Bruce Jefferis, chief executive officer of Global Energy at Aon, notes that energy companies have long designed their facilities to last for decades – especially on coastal areas.

“Energy companies spend billions of dollars to ensure that their facilities are prepared for the known types of disasters that can threaten their operations – from engineering through to safety programs and evacuation protocols,” says Jefferis.

In the past, many utilities companies simply shut off power during high-risk periods. Now, faced with an expanding wildfire threat, utilities are looking for ways to mitigate wildfire risks. And technology might also provide some of the answers.

The Edison Electric Institute, an association representing all U.S. investor–owned electric companies, recently created a CEO task force to study both regulatory and technology solutions to wildfire exposure.

Southern California Edison, an electric services company, indicated plans to fortify its system to build wildfire resilience and reduce wildfire risk. The company is using covered conductors in key areas to reduce potential ignition caused by foreign objects contacting overhead lines. It is also taking steps to bolster its situational awareness capabilities to assess and respond to wildfire risks, using infrared equipment to inspect equipment and adopting even more aggressive vegetation management activities.

Among the other tech solutions used to identify and address wildfire exposures are drones and other camera or sensor technologies.

Back To Basics: Prioritizing Vegetation Management

In addition to responsible placement and response protocols, “proper vegetation management is the key,” Fishbaugh says. “We cannot broadly say that the utility lines are faulty or that safety programs aren’t in place. For many of these incidents, it’s basic blocking and tackling of vegetation.” As the threat intensifies, broader discussion of vegetation-management practices as a whole might shift to better address the risk.

Reinsurance Market: Creatively Transferring The Risk

As wildfire risk escalates, some insurers are reducing their capacity or raising their prices for cover. Utilities are therefore looking for ways to transfer some of the risk, and reinsurers could hold the answers. “Options might be little pricier,” Fisbaugh says, “but some power companies could find capacity by going straight to the reinsurance markets.”

Legislation And Addressing The Threat

According to Fishbaugh, growing wildfire risk might create pressure for more stringent legislation that could focus on both safety and utility liability limits.

In September 2018, the state of California implemented a law requiring power companies to submit wildfire mitigation plans, collaborate with CalFire (California’s state fire unit) to address wildfire-related issues and develop a list of independent evaluators to assess electrical-infrastructure safety. Eight California utilities submitted their wildfire mitigation plans in early February 2019. While the threat isn’t limited to just California, the strict liability and inverse condemnation statutes are the single largest contributor to utility-specific liability exposures in the state, explains Fishbaugh.

As Risks Change, Risk Management Approaches Must Adapt

Existing risks evolve and new risks emerge. Power companies’ response to growing wildfire threats is an example of an industry rethinking its risk approach in the face of new exposure.

“Wildfires have become a critical issue, and the situation is a volatile one right now,” says Fishbaugh. “Going forward, we’ll continue to see the industry apply innovative approaches to address the growing risk.”

The post How Wildfires Have Sparked Change In The Power Industry appeared first on The One Brief.