OVERVIEW

For all the year’s headlines about hurricanes, wildfires, Brexit, and the redrawing of global trade agreements, organizations are managing through the volatility to best capitalize on opportunities. Last year also saw record global mergers and acquisitions activity, and more than $75 billion is expected to be raised through stock market listings in the U.S. alone – and 2019 is predicted to be even bigger.

In Depth

While volatility will persist in 2019 and beyond, organizations can take steps to manage it. Here, five senior Aon leaders share their thoughts on the significant issues organizations will face in the year ahead and how to address them.

Using Data to Maximize Performance And Manage Through Uncertainty

Industries are going through change. Consumer preferences are driving significant shifts in traditional business models. Industries are being disrupted and, seemingly overnight, new business models have emerged.

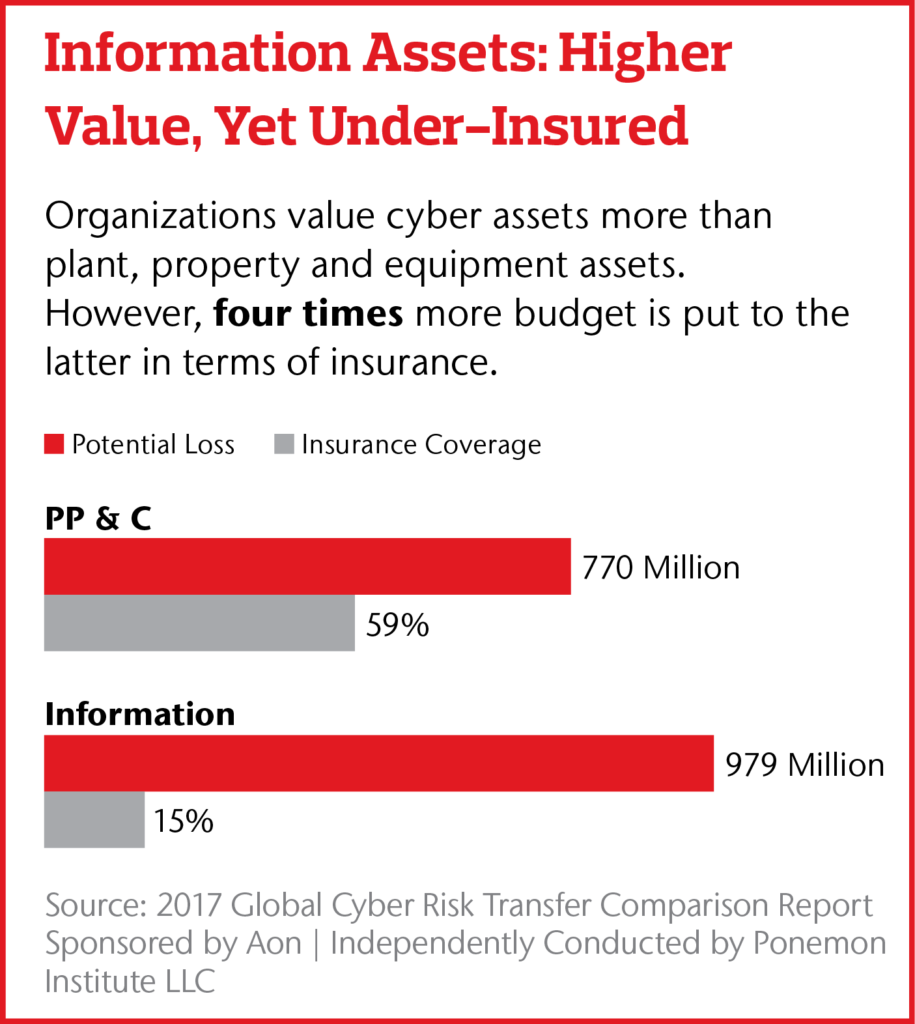

And while there is risk, there is also tremendous opportunity. In less than two decades, the S&P 500 has seen technology firms move into the 10 biggest companies as intangible assets such as intellectual property, data, brand and patents replace tangible ones. But as these assets grow in value, there is a lag in how organizations are protecting them, with more than four times as much budget going into the insurance protection of physical assets, versus intangible ones.

Using various models and predictive analytics, we’re working more broadly with business leaders to develop solutions that can better protect balance sheets while also uncover opportunities. Understanding historical patterns, having a view into what’s possible – or even probable – helps make data real. As digital transformation continues and we begin to realize the future of industry across traditional sectors such as manufacturing and construction, more data will generate analytical insights that can move companies into real-time decision-making. Whether to mitigate or manage through a risk – or capitalize on an opportunity – these insights can lead to competitive advantage.

– Lori Goltermann, Chief Executive Officer, U.S. Commercial Risk and Health Solutions, Aon

Re-Prioritizing De-Risking And Closing The Capital Efficiency Gap

Since the global financial crisis a decade ago, many organizations have taken steps to de-risk their balance sheets, increasing their resilience and sustainability. Fast forward to today and we might be at a tipping point and in danger of possibly forgetting the lessons learned immediately after the crisis – including the benefits of risk transfer.

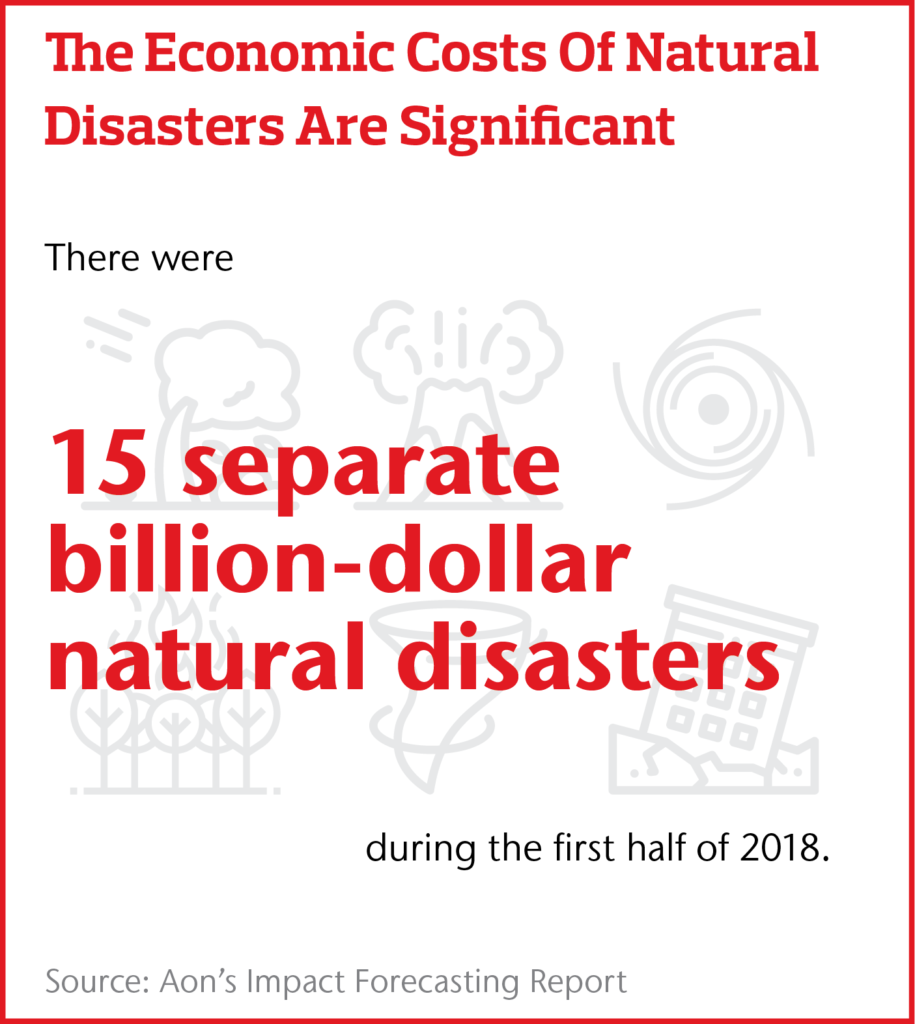

For example, the first half of 2018 saw more than 150 natural disaster events around the world, with the latest economic costs estimated at $45 billion. The insured losses associated with those events, however, were originally estimated at $21 billion – a 40 percent decrease from the 10-year average. An example of that insurance protection – or “capital efficiency” – gap is evident when looking at losses related to Hurricanes Harvey, Irma and Maria; less than 50 percent of the total economic loss translated into the insurance or re-insurance sector.

Whether disaster-related or forward-looking to prevent large-scale economic crashes, there is still a tremendous opportunity for the re-insurance sector to continue to assist firms, governments and countries in their de-risking efforts and better protecting their balance sheets. These types of efforts help build resilience to large-scale shocks and support economic progress.

– Andy Marcell, Chief Executive Officer, Reinsurance Solutions, Aon

Addressing Financial Wellbeing Among Employees and Employers

Over the past decade, we’ve seen employers shift the responsibility of retirement and health care decisions to the employee. But when it comes to broad financial wellbeing, the reverse is happening. Today, 14 percent of employers have a financial wellbeing strategy for their workforce– expected to grow to 62 percent in just three years. A worker’s ability to confidently manage today’s finances while preparing for the future is driving more stress in the workplace. With approximately three out of four U.S. workers living paycheck to paycheck, financial stress can compound health issues such as anxiety and depression. Employers see the value in acting before it creates short-term productivity issues and long-term retirement problems. Investing in educational programs or savings tools can ease employees’ stress and help them feel more confident in their ability to manage their financial lives today and in the future.

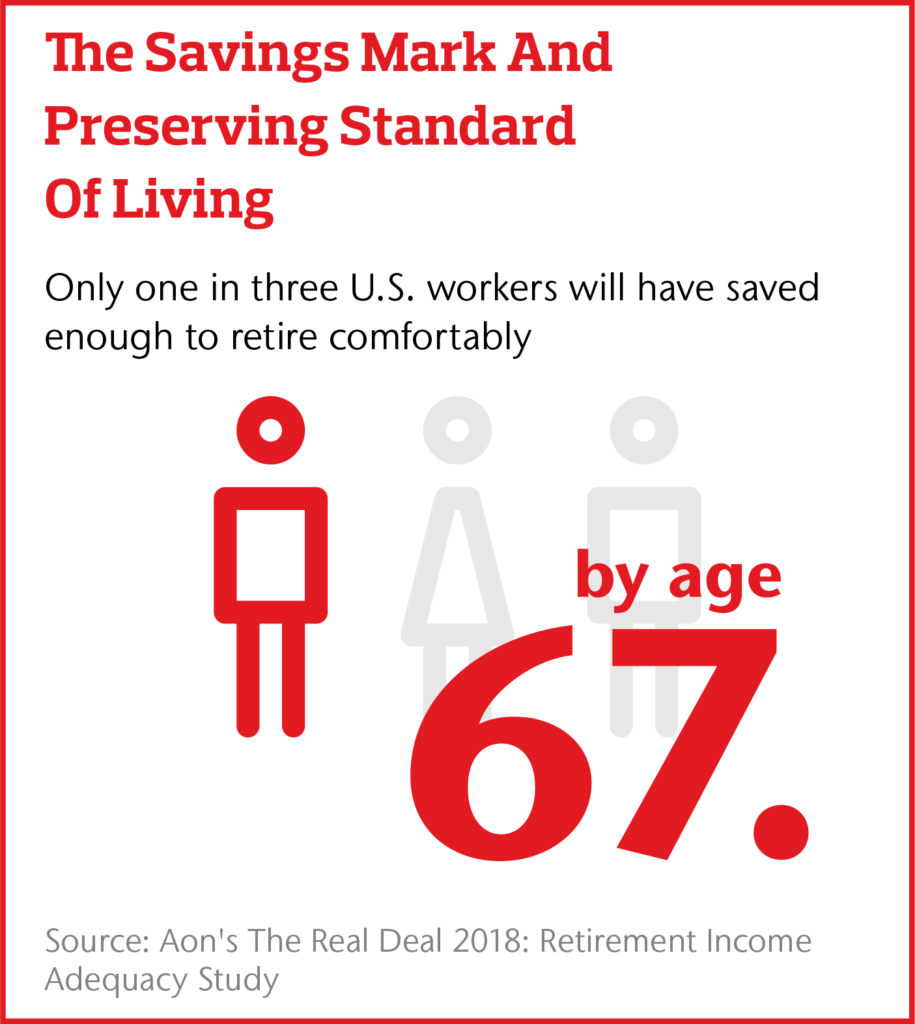

Massive swings in market volatility also make it more challenging to manage investments. Around the globe we’re living longer, and retirement and pension plans are facing a deficit of close to $1 trillion. Our recent research shows only one in three U.S. workers are ready to retire at 67– delaying retirement or reducing retirement income is becoming a reality.

Indeed, prioritizing overall financial wellbeing is imperative to increasing the population’s overall education and best plan for their financial future. Regardless of the specifics of the program, organizations with financial wellbeing programs tend to have more employees contribute to their retirement plan, feel satisfied with that plan and save for health care expenses.

-Cary Grace, CEO, Global Retirement and Investment, Aon

Addressing Health Holistically Amid Constant Change

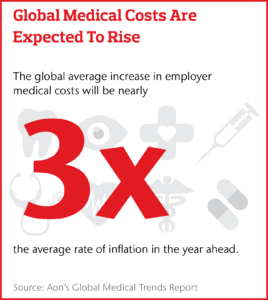

Health care costs continue to increase at rates outpacing inflation, posing challenges for governments, employers and individuals across the globe. As these costs are rising faster than wages increase, employers are finding that their health care costs are consuming a disproportionate share of total rewards budgets. At the same time, the world’s population is becoming less and less healthy, with chronic illnesses such as diabetes and heart disease on the rise everywhere in the world. From lost productivity to increased premiums – poor health affects balance sheets.

From varying regulations to differing delivery systems, the global health care landscape is complex. Take the U.S., for example, where the entire health care industry is shifting at an unprecedented rate. Health care providers – from hospital systems to doctors to pharma and even newer players in the industry such as technology firms – are trying to drive innovation in an effort to improve the overall state of health care, from costs through to long-term societal implications.

Amid this landscape, personal health technology, such as wearable devices and apps that can detect blood sugar levels or heart rates, is emerging to encourage individuals to better understand and manage their own health. Increasingly, organizations are realizing that health is not just physical. A combination of factors – including emotional, social and financial – can affect an individual’s wellbeing. To best manage the long-term impacts of poor health, including shorter-term cost containment through to longer-term behavioral change, organizations across the world are looking at wellbeing programs that aim to educate, motivate and support various elements across an individual’s health.

– John Zern, Chief Executive Officer, Health Solutions, Aon

Gaining Competitive Advantage By Embracing Enterprise Analytics

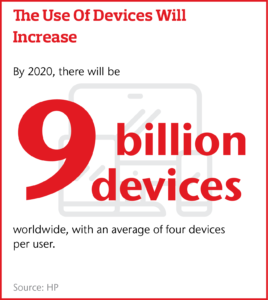

Billions of devices are already connected to the internet, and that number will increase at breakneck speed. As the internet of things continues to grow, and more data is generated from sensors through to personal smart devices, connecting the right systems and using the same language across a company so that it can best extract insights that come from this data will continue to be a priority.

Predictive modeling has already shown us how data can help drive smarter decisions. Coupled with artificial intelligence, the possibilities to move to more real-time decision making are upon us. For the companies that do it well, the data itself and the insights derived from it, will drive competitive advantage. To truly gain that advantage, though, organizations should view the opportunity holistically.

Having a firm-wide handle on the data various functional groups have and how that data can answer bigger-picture questions can help create scalable and reusable solutions. Using a common set of analytical tools and language throughout the enterprise, will be critical in extracting the right insights at the right time to enable strategic growth. Organizations, ours included, are continuing to invest in platforms that enable real-time decision making. Having unique insights – including how to best deploy financial and human capital – allows leaders to anticipate and capitalize on market opportunities. Using data wisely can drive competitive advantages and will likely see clients, investors and even ratings agencies reward these efforts over time.

– John Bruno, Chief Executive Officer, Data & Analytic Services, Aon

The post Top Business Trends For 2019: Managing Volatility And Enabling Growth appeared first on The One Brief.