OVERVIEW

Over the past few years, changes in demographics, regulations and the ways data are collected and interpreted have led to shifts in how large institutional investors choose how and where they allocate their funds.

Increasingly, investors are looking at “responsible investing” to ensure that their money is being used for a greater good. According to the United Nation’s Principles for Responsible Investment, activity has been dramatically rising. Despite the growth, a significant obstacle remains: lack of a standard definition.

A 2018 report from Aon aims to better categorize these so-called responsible investments to reflect the latest trends: an increasingly younger – and female – investor profile; new regulations; and the growing use of data to inform longer-term trends.

As John Belgrove, senior partner of Aon’s Retirement Practice, explains, “Regardless of how people are defining these newer types of investments, the trends are clear: attitudes across various stakeholders, including institutional investors, are changing. Signs are pointing toward more responsible investment.”

IN DEPTH

To assess whether investment managers are considering responsible investment – and to move toward a standard definition of the term – Aon has developed a rating system for fund managers. The aim is to help investors more efficiently navigate the responsible investment landscape.

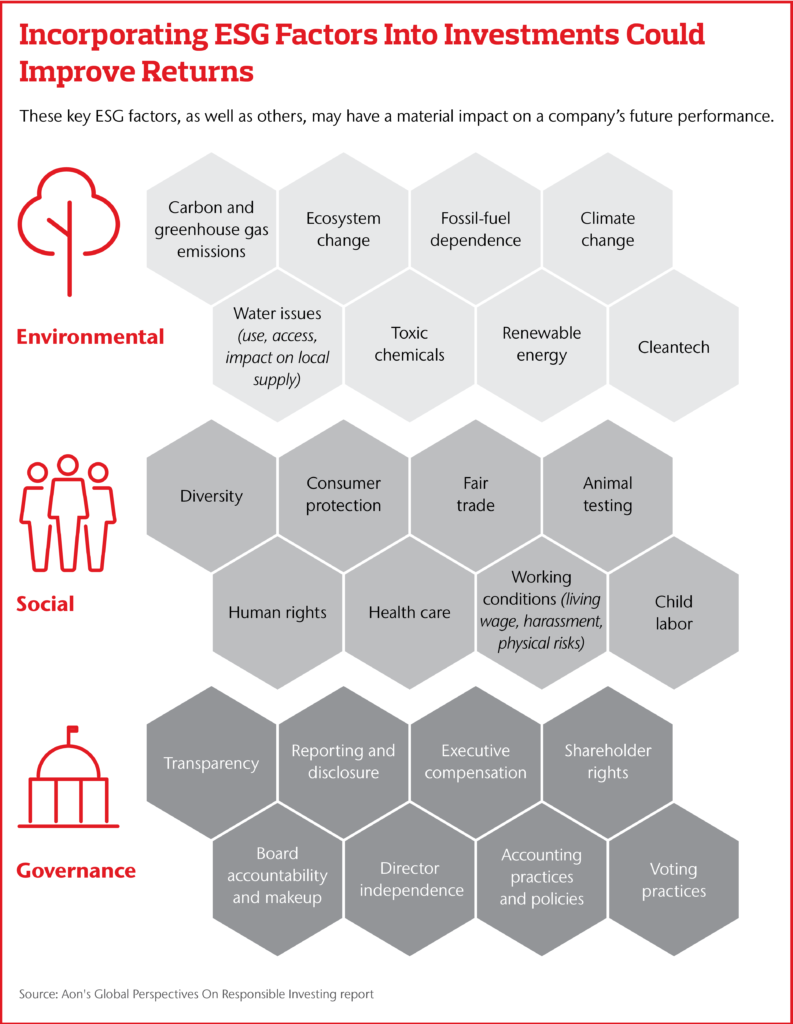

Environmental, Social and Governance (ESG) Factors

Of the four primary subcategories of responsible investment, ESG investing is by far the most practiced, with 47 percent of respondents indicating their organization integrates ESG factors into investment decisions.

Meredith Jones, partner at Aon’s Retirement Practice, suggests, “When you look at ESG, it’s about evaluating companies on their nonfinancial factors, such as workforce safety, environmental impact and governance practices like board diversity and CEO pay, as well as their financial factors. Companies that exhibit strong financial and nonfinancial factors are likely to perform better over the long term.”

Belgrove adds, “These criteria help to define the terminology and illustrate the hierarchy of issues that businesses and investors face.”

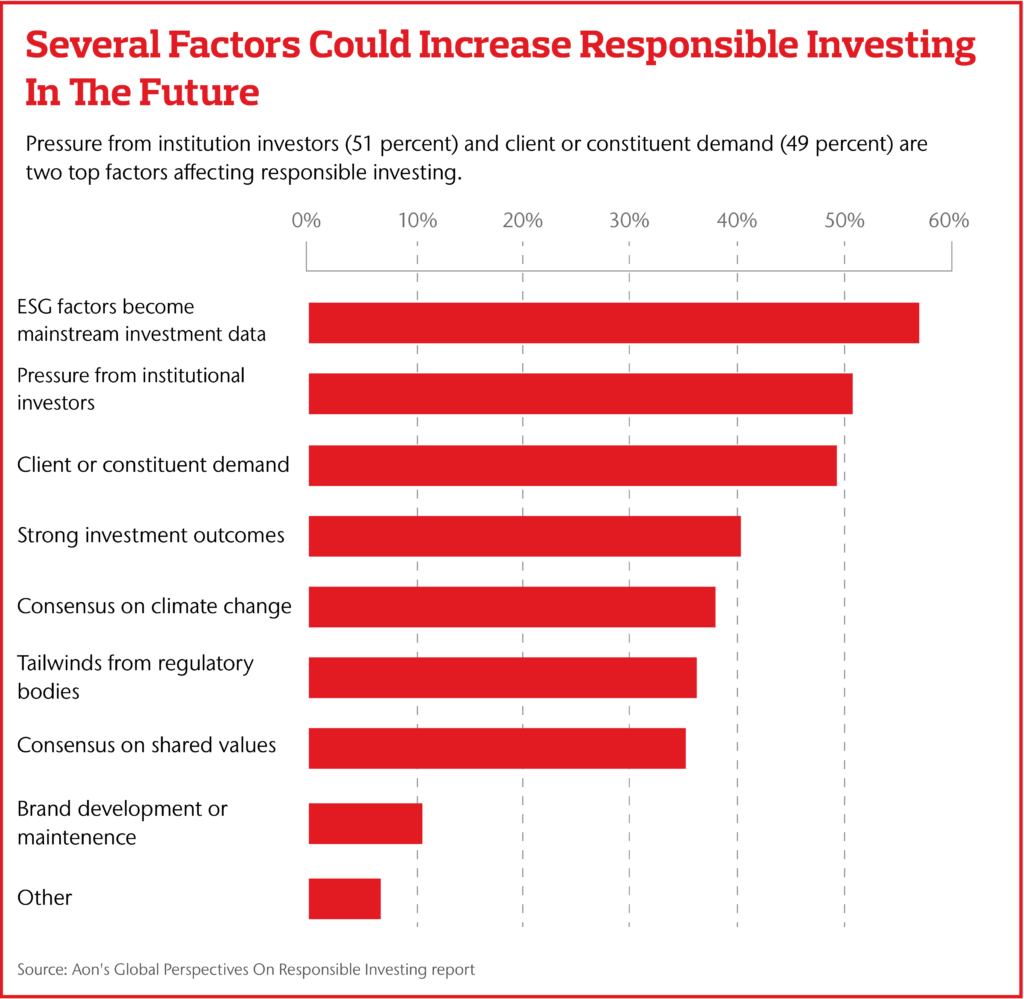

When respondents were asked why they had chosen to implement a responsible investing initiative within their organization, 39 percent indicated they had done so due to a belief that the incorporation of nonfinancial ESG data resulted in better investment decisions.

The integration of ESG factors coincide with a greater volume of ESG data. Investors and companies are making progress in assessing ESG quality and making that data available. In all, 57 percent of the investors we polled believe that ESG data will go mainstream and be a key driver of responsible investing going forward.

The Future of Responsible Investing

The trends that fueled the rise of responsible investing will not go away. If anything, investors, employees and the general public may continue to demand greater transparency into corporate practices and their impact on the world. And if analysts can establish a link between a company’s commitment to ESG factors and financial performance, the effect could be far reaching.

The post Defining Investments: Trends In Responsible Investing appeared first on The One Brief.