OVERVIEW

China has embarked on one of the most ambitious and expensive infrastructure projects ever undertaken. First announced in 2013, One Belt One Road, also referred to as Belt Road Initiative (BRI), represents a resurrection of the ancient trade routes known as the Silk Road, which connected China with the economies of nearly 70 other countries across several continents.

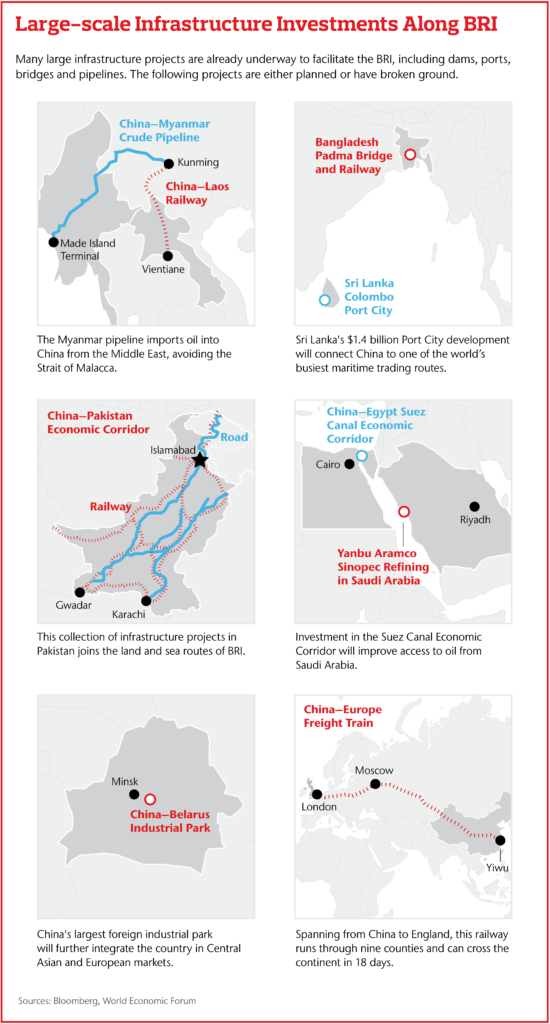

The project is made possible by updating the infrastructure along ancient trade routes both on land and at sea. In fact, the “belt” refers to the physical road, which travels from Asia through Europe and into Scandinavia, whereas “road” refers to the maritime shipping lanes, reaching as far as Venice.

One of the main arguments for the BRI is that increased global trade can lead to global growth. Nonetheless, the challenges of the project shouldn’t be underestimated. From political risk to simple economics, such cross-border trade can easily become very complex.

In Depth

The BRI presents several challenges and opportunities to countries along the route – as well as those that could be affected by investments or implications to their supply chain. From varying regulations to political risk, such an expansive project carries implications across borders.

A Truly Massive Investment

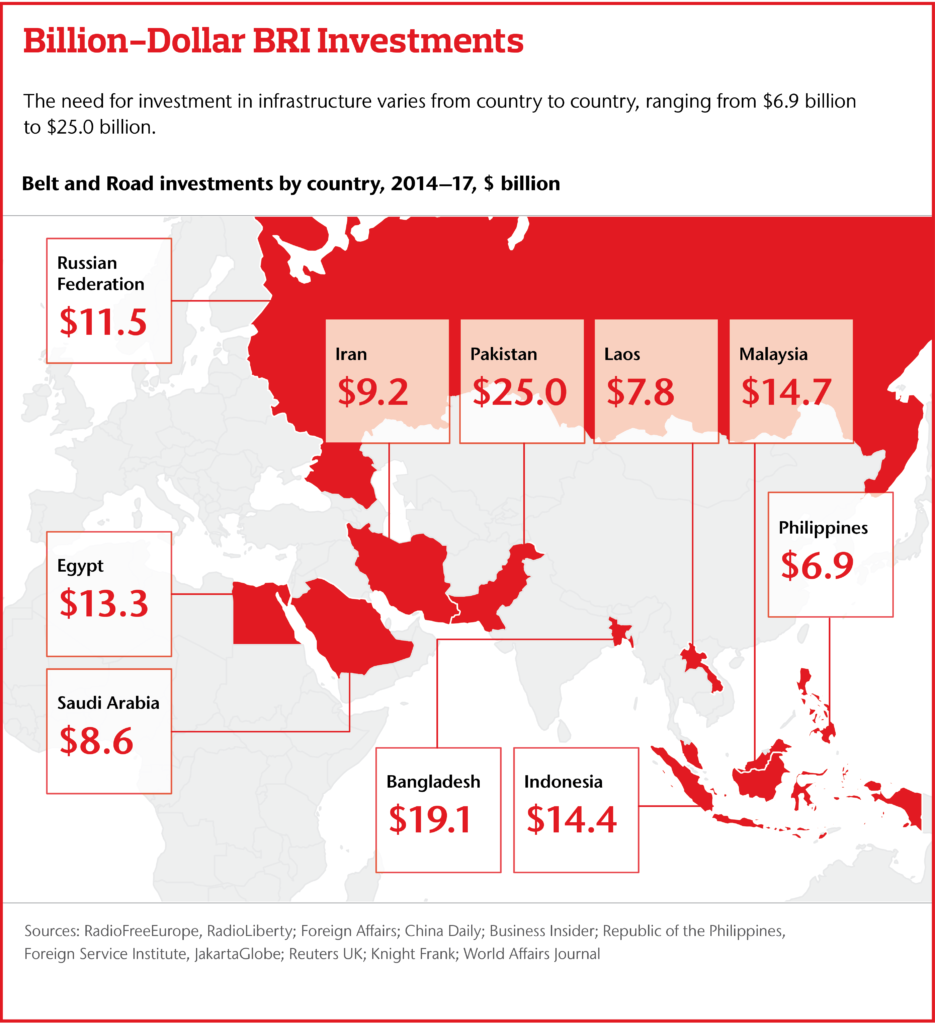

Together, the routes of BRI will reach some 65 percent of the world’s population, one-third of the world’s economy, and nearly a quarter of all goods and services. The project itself will require decades of construction and carries a trillion-dollar bill.

The investment is expected to bear fruit. Some estimates suggest that more than $2.5 trillion of annual trade value could be realized once the project is fully completed.

One of the predicted trade outcomes is more frequent freight train services carrying manufactured products from China to Europe and, potentially, ferrying goods and commodities back. Some of these high-value goods include electronics, cars, fashion, auto parts, agricultural goods and meat.

Furthermore, the BRI’s new routes could reduce journey times for these goods: from 60 days at sea to 14 days by land.

Tariq Taherbhai, chief operations officer, Global Construction and Infrastructure practice at Aon, notes that in addition to trade outcomes, societal benefits such as improved roads can drastically improve quality of life for various stakeholders. On the infrastructure investment front, “businesses in particular stand to actively benefit when they are a part of the financing and development of the physical infrastructure projects.” However, Taherbhai adds, such business investment can be reliant on political will, which can easily shift.

Adressing Political Risk Across Countries

John Minor, director, Crisis Management and Political Risk at Aon, notes that China’s ambitious plans for the BRI has the potential to create new or increased political risks for companies participating in these large infrastructure projects. Some of the countries benefiting directly from China’s BRI are considering pulling out of these large projects. For example, Malaysia’s newly elected prime minister, Mahathir Mohamad, has voiced concerns over China’s increased influence and has suspended $40 billion of Chinese infrastructure projects pending further review. Other countries in the region, including Indonesia, Thailand and the Philippines, have raised similar concerns about their growing dependence on Chinese investments in infrastructure.

Because balances of power shift, governments change and new policies come into play, Minor stresses the importance of understanding political risk prior to making a significant investment in countries historically prone to political or economic volatility. Minor states, “Business leaders should have a clear understanding of the possible risks they face across borders in advance of beginning projects or signing contracts. Due diligence at the start is critical to developing clear risk-management strategies to address the potential impacts of these risks on their business.” Uncertainty about the future of trade relationships – how contracts will be affected, implications to supply chain and a business’s overall ability to market in certain geographies – can make business decisions much more complex.

Security Perils Along The Route

According to Daniel Bould, regional director (Asia), Crisis Management at Aon, companies operating on BRI-linked projects face various security-related perils. These hazards extend from physical assets to employees who can be exposed to threats of kidnap for ransom, illegal detention and extortion along these routes. In many emerging markets, employing local security forces to resolve the situation in a timely and safe manner might not be a viable option.

Bould says, “Organizations have duty-of-care obligations to their staff, contractors, local nationals and expatriates.” In the case of kidnap, many organizations find themselves without a clear plan when an employee goes missing. He continues, “Awareness of these risks and the need to implement preventative measures for such an incident is critical. An understanding of the worst-case scenario can help build plans that include access to experienced international experts to assist them in a successful resolution – if needed.”

Connecting Across Borders And Trade Agreements

On the flipside, connecting regions (including their various currencies) across borders opens up economic implications. “The One Belt One Road project is a great example of how trade and geopolitics converge,” says Tapan Datta, head, asset allocation at Aon. “What happens in one market – whether a dip in currency value or issues with tariffs – can have dramatic impacts to certain investments in the larger project.”

Nearly 70 countries comprise the BRI, representing regions such as East Africa, Europe and Asia. China is reportedly spending $150 billion per year in the countries that have signed up for the plan.

The recent global growth of trade has led to the expansion of regional trade agreements (RTAs), which are reciprocal in nature and designed to protect two or more partners. RTAs are authorized by the World Trade Organization (WTO) and subject to clearly defined rules. The number of RTAs has jumped from 124 in 1991 to more than 400 today.

It’s almost certain that the BRI will lead to even more of these agreements. As such, the Organization of Economic Co-operation and Development (OECD) has argued that RTAs provide stronger trade agreements between countries beyond their designated regions, which in turn increases access to emerging markets. However, there are some risks involved, including the danger posed to local businesses by increased competition.

Developments In Emerging Markets

An important aspect of this project is updating the infrastructure along time-worn trade routes.

An important aspect of this project is updating the infrastructure along time-worn trade routes.

Projects such as logistics centers, dams, ports and bridges have already been completed in many countries, including Hungary, Iran, Kazakhstan, Sri Lanka, Indonesia and North Korea.

However, rail-line delays in Indonesia, and similar issues in Kazakhstan and Bangladesh, have created significant setbacks. In addition, a few countries have plunged into debt to China.

These developments, as well as China’s takeover of a port in Sri Lanka, have raised concerns with sovereignty. In fact, according to one article, the BRI has already increased debt risk in eight countries.

What’s On The Horizon For The BRI?

While the full scope of the BRI is still to be determined, improved infrastructure, in general, can lead to gains for everyday people within the region. “No matter where you’re located – a large city or a rural town – infrastructure is fundamental to your daily life,” Taherbhai states. “Whether you’re walking on a dirt road or driving on a highway, networks of transportation connect you to others, to commerce, to work.”

Across the globe, the BRI is likely to play a major role in how trade tensions between the United States and China evolve. According to the Washington Post, China is laying the groundwork for a post-American supply chain. Should more efficient global trade on the BRI lead to global growth, the domino effects – both positive and negative – are yet to be determined.

The post China’s Global Ambition: Balancing Opportunities And Risks In One Belt One Road appeared first on The One Brief.