OVERVIEW

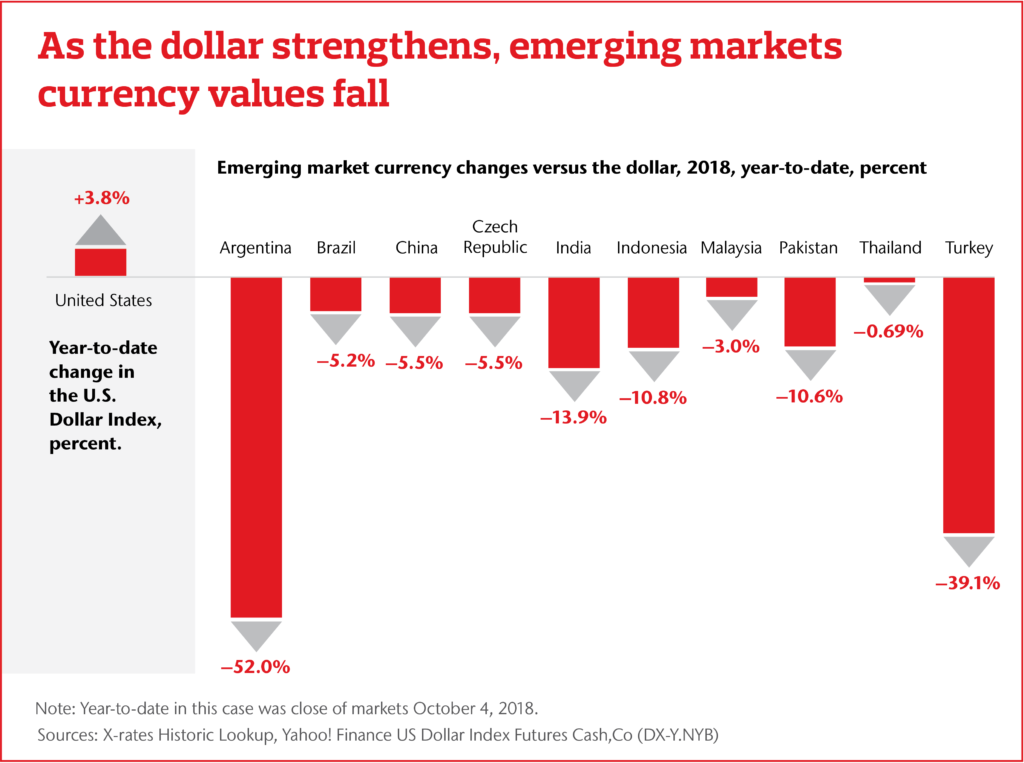

The world’s currency markets have been through some turbulent times. None more so than the past few weeks, when emerging market countries have seen their currencies dip significantly. Specifically, countries such as Argentina, Indonesia and Turkey have seen their currencies plummet – with the largest factor for the decline being the U.S. economy and strength of the dollar.

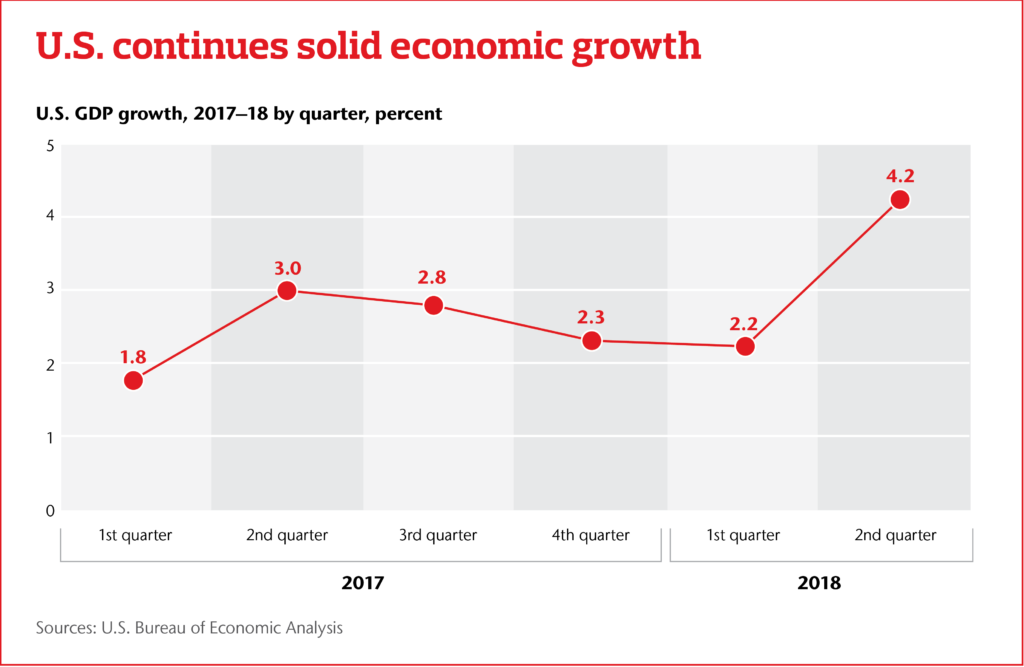

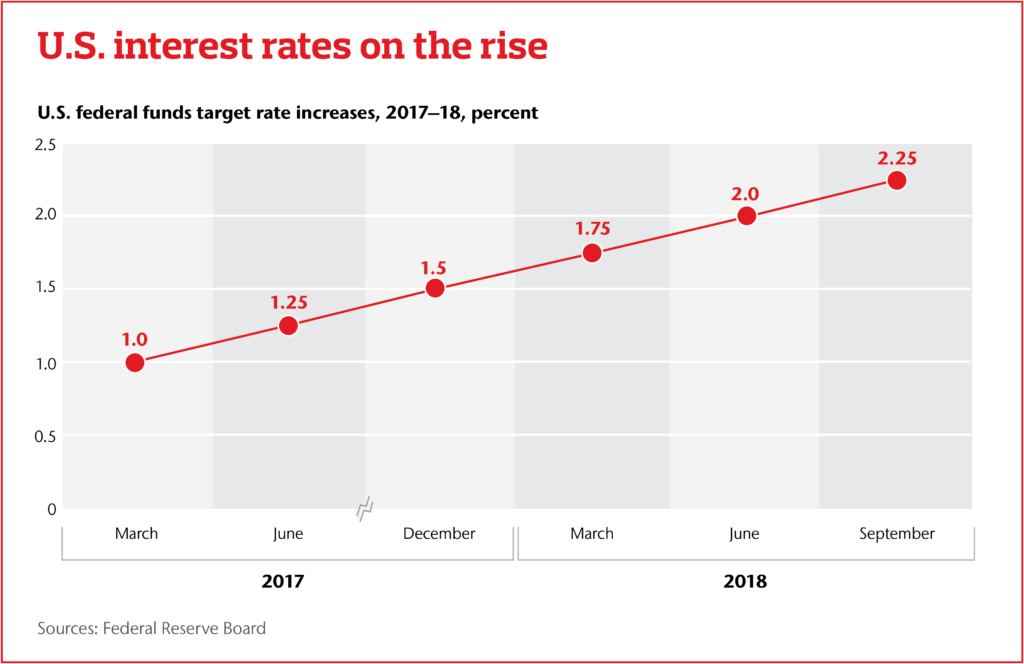

Fueled by recent interest rate rises, a strong U.S. dollar has led to the downturn in emerging market currencies. Looking forward, global trade uncertainty could drive further declines in currency values.

While emerging market countries’ currencies see more volatility than those of developed countries, Tapan Datta, head of asset allocation at Aon, states that they offer investment opportunities. Examining the historic sources of countries’ currency fluctuations and making informed decisions can help investors and businesses alike weigh both the risks and rewards that come with emerging market investments.

IN DEPTH

The MSCI Emerging Markets Currency Index – which is based on a number of emerging markets’ currencies – was down nearly 5 percent on the year in early October. As the U.S. dollar has become more attractive, conversely, emerging market currencies have been hit – largely due to the fact that any debt that was priced in dollars is becoming more expensive to manage.

Another factor that could increase pressure on emerging market currencies is the impact of trade uncertainty between the U.S. and China, Datta said. So far, the renminbi, the official currency of the People’s Republic of China, has weakened only slightly. Datta notes that if the trade disputes worsen, there could be drops in the value of China’s currency.

Another factor that could increase pressure on emerging market currencies is the impact of trade uncertainty between the U.S. and China, Datta said. So far, the renminbi, the official currency of the People’s Republic of China, has weakened only slightly. Datta notes that if the trade disputes worsen, there could be drops in the value of China’s currency.

Easing The Downward Pressure

In an attempt to bolster their currencies, emerging market economies have already begun making necessary monetary and fiscal adjustments.

“Another thing to note,” Datta said, “is that while the dollar is currently very strong, over time, it might adjust.”

He states that among the most significant factors likely to weaken the dollar’s value – and boost the value of currencies elsewhere – is the large U.S budget deficit, which remains to be seen.

Finding Opportunity In Currency Volatility

Investors and businesses looking to emerging markets must understand that those countries’ currencies experience greater volatility than those of developed market currencies such as the Euro or the Yen. But the rewards might be there for those who make efforts to understand that volatility, particularly if they are willing to make longer-term investments, Datta explained. Over time, as markets continue to develop, these investments can pay long-term dividends despite short-term declines. “Emerging markets offer higher returns at the price of higher volatility,” Datta said. “If you manage the risk well, over time, emerging market investments could reward you well for that added risk.”

The post The Global Ties That Are Fueling The Volatile Currency Markets appeared first on The One Brief.