Overview

A lot has changed in the world of employee health care benefits since 1798, when the U.S. Marines opened what is considered the first hospital system for its servicemen – paid for by salary deductions. Since then, benefits have expanded to encompass everything from health insurance to parental leave and gender dysphoria.

As medical costs continue to rise, companies large and small seek to limit increases in a variety of ways, such as wellness programs and employee incentives. Still, health care benefits costs continue to rise. Aon’s 2019 Global Medical Trends Report forecasts the global average increase in employer medical costs will be nearly triple the average rate of inflation in the year ahead – causing global companies to re-examine their traditional strategies and explore innovative approaches.

As employee health care benefits account for a larger proportion of operational expense, present a source of cost volatility, and are increasingly important in talent attraction and retention, decisions around employee benefits are beginning to form part of the enterprise risk-management agenda.

Alan Oates, a Hong Kong-based principal and actuary for Aon’s Global Health & Benefits, advises multinational companies on employee benefits strategies. He notes, “Organizations face increasing pressure particularly from the costs of medical treatment. The need to moderate health care costs is raising questions about the efficacy of insurance as the most appropriate funding and risk-transfer mechanism.”

Some multinational organizations have embraced a portfolio approach to employee benefits management and risk pooling. This approach enables them to capture economies of scale and scope and respond more nimbly to emerging needs – a critical advantage when trying to provide benefits to a globally dispersed workforce.

In Depth

Multinational companies must address two challenges when managing their employee health care benefits. The first is the ever-present struggle to control health care costs. From 2003 to 2017, for example, the cost of employer-provided family health insurance in the United States doubled, reaching nearly $19,000. The second is providing a set of benefits that meet needs across developed and developing markets. Navigating the array of regulatory environments as well as different levels of maturity in the insurance industry means that companies must devote significant time to patch together benefits packages that fit within a consistent framework and philosophy.

As a result, many companies follow a standard process for developing and managing employee benefits: identify a need, assess and select the appropriate coverage product, and renew on an annual basis while implementing interventions to slow the rate of cost increase. According to Oates, this approach maintains the status quo but can result in missed opportunities to tackle the source of the problem.

Innovative organizations are using a different strategy for benefits planning by viewing insurance options along the spectrum of risk retention and control. As Oates explains, “Large multinationals have a real opportunity to use their scale to pursue a number of different options along this spectrum. Indeed, for some of the emerging benefits that leading companies wish to implement, noninsurance options are the only viable funding vehicle.”

Typically, there is a correlation between the level of risk retained and the degree of centralized control in the organization. At one extreme, organizations permit the financing decision to be made autonomously at the local level. At the other, local offices are not involved at all in financing decisions. In practice, most organizations move along this continuum depending on the situational need. Oates provides an example: “A global underwriting arrangement may be used for life insurance benefits that require low levels of local administration. By contrast, a multinational pooling strategy may be implemented for disability and certain medical and pension benefits that require more local administration expertise. And self-insurance or captive solutions can be used for coverage of emerging benefits that may not be able to be insured such as gender affirmation, same gender domestic partner coverage or mental wellness.”

One might expect that the options above represent a significant financial risk transfer decision for the organization, but in Asia this is not the case. As Oates explains, “Third-party medical insurance in most Asian markets operates financially more akin to ‘rent-a-captive’: most of the cost volatility is passed onto the policyholder, and there is very little risk pooling between organizations. As a result, risk transfer tends to be less about financial considerations and more focused on operational considerations.”

To achieve those operational returns, scale is usually a necessity. According to Oates, “Some organizations have put employee benefits into captives because they have very significant scale and can do so cost-effectively.”

Even if an organization decides on a captive solution, implementation can still be complex. Oates warns, “Changing the financing mechanism of employee benefits is a challenging exercise. Organizations need to consider myriad issues, including legal constraints, taxation, contractual issues, licensing fees, regulatory obligations, vendor management, internal stakeholder management and technology integration.” These factors are perhaps the reason that captive solutions are still relatively uncommon in employee benefits management.

Even within traditional third-party insurance there is still plenty that organizations can do to manage costs. As Oates observes, “When 80 percent of your insurance cost is the claims themselves, that is where you should focus your effort. It is important to look through the insurance wrapper to analyze the underlying claims activity, develop a detailed picture of the cost drivers and identify appropriate interventions to manage the risk. Doing so helps the market better regulate the cost of health care.”

The attractiveness of these financing options can vary from industry to industry. Captive solutions use the economic capital of financial institutions while insurance transfer does not — even though the volatility of both funding mechanisms in Asia is similar. However, some nonfinancial institutions with significant global scale have successfully used captives to achieve cost savings and operational improvements.

Responding to Emerging Employee Needs

Multinational companies have shifted their approach to employee benefits in part to address the needs of a changing workforce and demographic trends. Since a traditional approach to risk and underwriting can sometimes limit a company’s ability to provide new products or benefits, executives are increasingly exploring innovative arrangements.

Two examples from the technology industry demonstrate the advantages of a flexible portfolio.

Addressing Multigenerational Benefits. Demographics, both at a macro level and for specific workforces, can create a desire for new benefits. While traditional health and benefits options include dependents such as children or spouses, Oates notes an example in which executives at a tech company identified the desire among employees to purchase supplemental medical insurance for their parents. Since public coverage can differ dramatically among countries — the U.S. has Medicare for all people aged 65 and older, and other markets have very limited public health coverage — the company worked with a global insurer to offer voluntary parental medical insurance as part of its benefits package in a direct response to their employees’ needs. The pooling of the risk across employees helped to lower the cost of coverage.

Elective High-Cost Procedures. Organizations often choose to expand benefits to offer elective health care services — those that are not deemed medically necessary. Oates shares another example of a tech company seeking to add gender reassignment insurance to its benefits package but being unable to secure coverage with each of its local country insurance vendors. While the coverage would be offered to its global workforce, the assessed incidence of claims would likely be very low. Rather than wait on insurers to develop the desired products, executives decided to use self-insurance options including using its captive to offer the coverage.

As these two scenarios demonstrate, the flexibility to tailor coverage to different needs and markets increases responsiveness. In certain regions such as Asia, and certain industries such as technology, flexibility and responsiveness are key factors in attracting and retaining the best talent.

How Companies Can Pursue a Portfolio Approach

Global companies with significant scale are the best suited to adopt a mix of underwriting approaches to manage employee benefits and control costs. Multinationals can achieve this by following a three-step process:

Understand Industry Trends and Employee Needs. In an effort to keep pace with competitors, many companies will benchmark employee benefits packages in their industry. But Oates adds, “It is just as important to conduct internal benchmarking of employee needs, typically through trade-off analysis. This exercise enables an organization to focus on what is most important for its own employees rather than the industry’s workforce.”

Assess Options by Coverage and Region. The range of insurance products differs significantly among developed and emerging markets. The maturity of the insurance industry and degree of regulation can affect how global companies can offer a set of benefits to its workforce. Oates states, “Companies often need a much broader spectrum of tools to implement the required coverage because when they go to the insurance markets, they can sometimes become frustrated by the lack of options or speed at which products are developed.”

Balance Risk Retention and Cost. Companies that adopt a portfolio approach for their benefits programs can approach each new coverage type afresh and strike the optimal balance between risk retention and cost. “By judging each scenario on its merits and not being tied to one financing option, companies are free to select the best risk-adjusted solution,” said Oates.

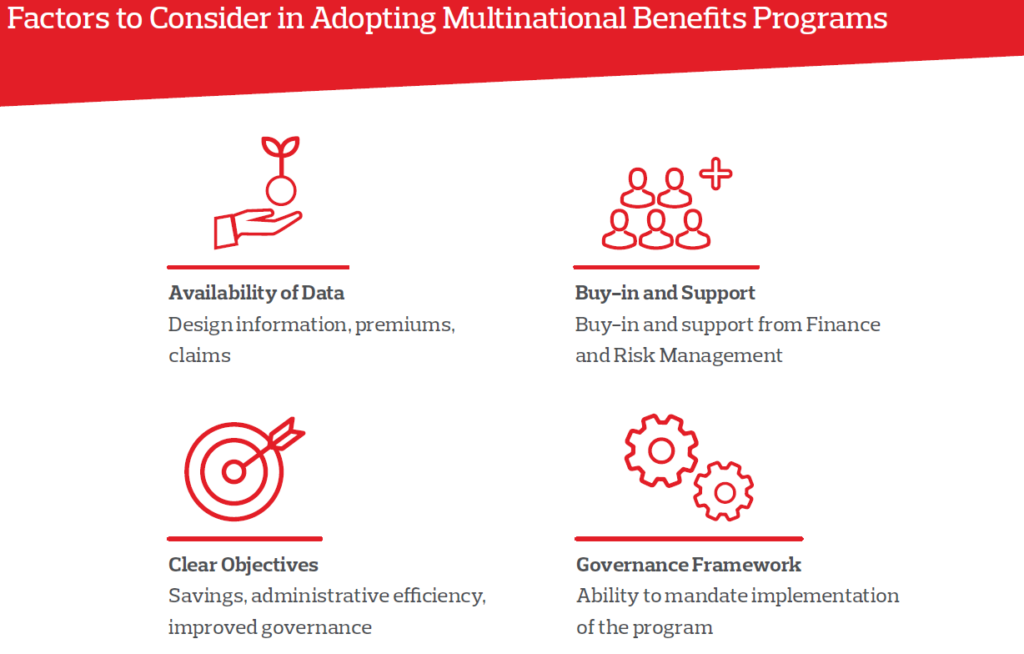

Once companies identify the coverage and approach, they must manage the procurement process carefully to achieve their goal. Four factors are essential to this effort.

******

As employee health and benefits continues to shift, companies – particularly those with global scale – can’t afford to rely on traditional approaches to risk transfer. Instead, the portfolio model can offer a better response to emerging needs, capture economies of scale and give companies the ability to manage risk more effectively.

The post To Control Employee Health Care Costs, Companies Consider A New Approach appeared first on The One Brief.