Overview

Health care: It’s the cost that businesses have had the hardest time trying to control. While inflation has remained steady, total global spending on health care is expected to reach $8.7 trillion by 2020, and longer-term trends suggest that health care costs will continue to rise dramatically. What makes containing health care costs so vexing is that multiple factors – everything from access to quality health care and socioeconomic trends to diet and exercise – must be managed effectively to slow spending growth.

Since many governments now spend between five and 10 percent of their overall GDP on health care, the benefits of reversing the current trajectory are significant. The private sector also has a vested interest in finding solutions: An unhealthy workforce not only increases benefits costs but hinders productivity.

Recent Aon research has taken an international approach to analyzing health care – taking a global overview as well as deep dives into Asia’s health costs and employer programs in Europe, the Middle East and Africa. The research has pinpointed the factors behind rising health care spending around the world as well as the actions employers are taking to increase worker health and productivity.

In Depth

The 2018 Aon Global Medical Trend Rates survey estimates that global medical costs will rise by an average general inflation rate of 3.1 percent this year (the difference between the global average increase in medical costs and the worldwide inflation rate). Indeed, nearly every country, from developed to emerging economies, and nearly every delivery structure, from single-payer systems to private health care schemes, is confronting rising health care costs.

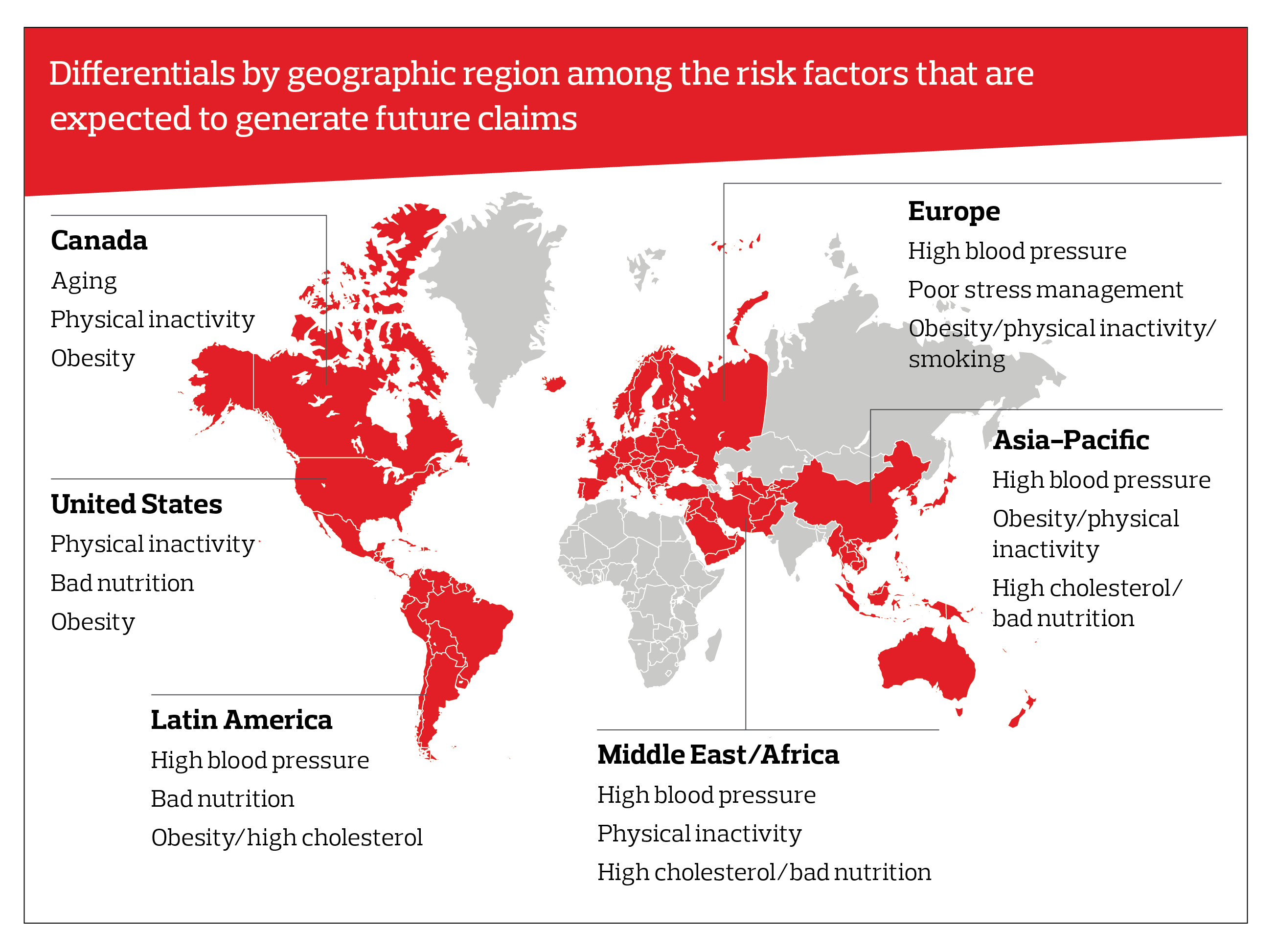

And the health risk factors increasingly responsible for causing this inflation are largely the same. A look at results by region highlights the impact of chronic diseases – many of which are preventable, such as physical inactivity, obesity and smoking – and the formidable challenges for public health officials.

Rapidly growing emerging economies are beginning to experience the same health care challenges as their developed counterparts, where sweeping changes in access to health care are hindered by shifts to a more sedentary lifestyle and a greater availability of processed foods. All this means that there are now some global trends in health care: Hospitalization, for example, is now the primary driver of medical costs in every region of the world.

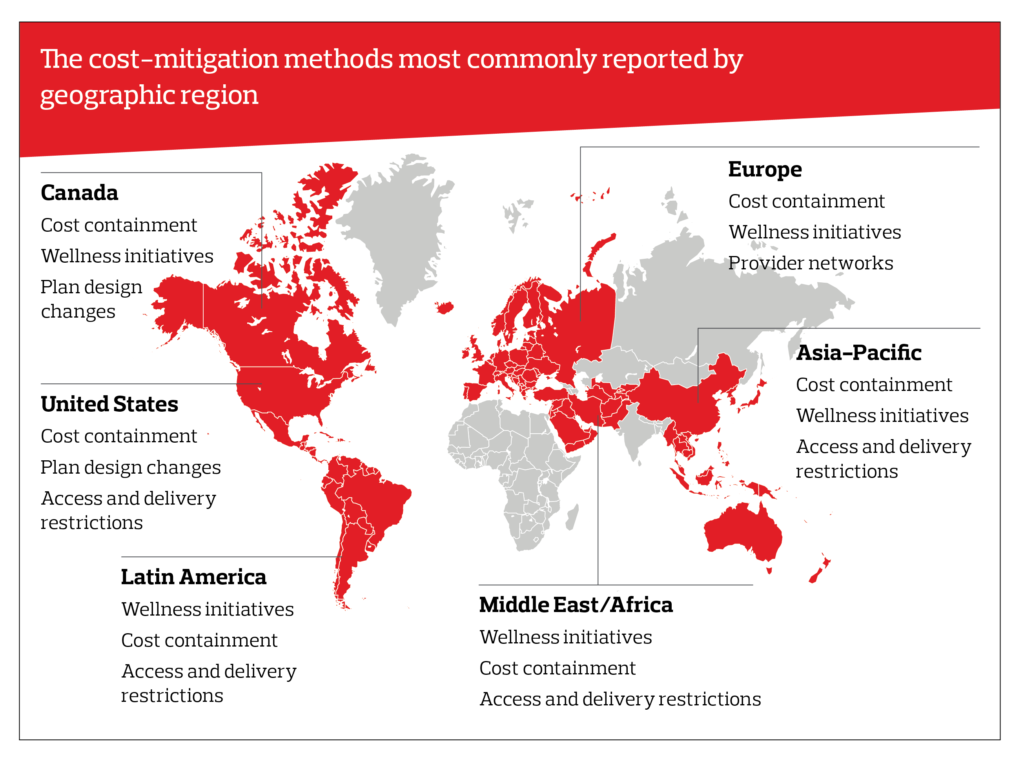

So how are countries in different regions looking to limit cost increases? Keeping health care costs low, known as “cost containment,” and wellness and wellbeing initiatives were the top two methods reported by respondents in the survey. While many U.S. companies have implemented wellness programs, the top cost-mitigation methods reported by U.S. respondents were plan-design changes and restricting access to and delivery of health care.

Asian Countries Push to Cut Health Care Spending

Despite the universal nature of rising health care spending, each country must address its own unique set of contributing factors. The Aon Asia Healthcare Trends 2017/18 report assesses medical inflation and its key drivers across 11 markets in Asia and highlights how stakeholders are seeking to improve health care and limit costs. The findings offer lessons that other countries around the world can apply.

One of the key observations is that markets across Asia are in the midst of a rapid demographic shift that has had a direct impact on public health. “As populations in Asia have transitioned from rural to urban centers, there has been a significant change in lifestyle behaviors characterized by adoption of Western diets, increased alcohol and tobacco consumption and lack of exercise,” says Tim Dwyer, CEO, Health and Benefits, Asia-Pacific, Aon

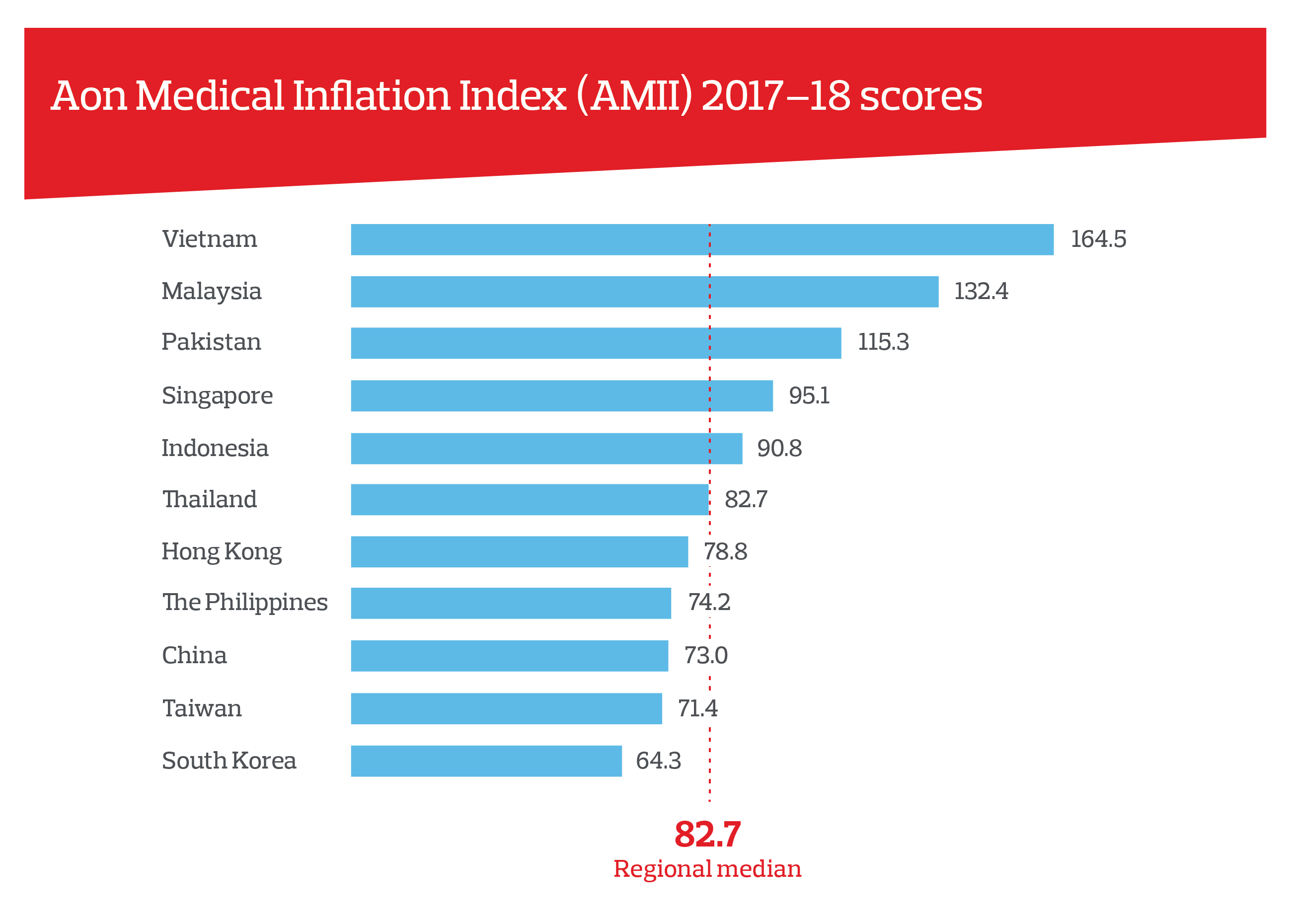

The Aon Medical Inflation Index reveals a wide range of performance by markets across the region. While the regional median score was 82.7, Vietnam had an alarming score of 164.5 while South Korea shows the lowest projected inflation rate with a score of 64.3.

Aon research identified inpatient care as the primary cause of rising health care costs. Patients suffering from chronic diseases, such as heart disease and Type 2 diabetes, are either not being screened early or choosing to avoid treatment until their symptoms warrant more expensive inpatient intervention. Indeed, eight of the 11 markets in the study reported that cancer and cardiovascular diseases rated as their top two inpatient costs. “Inevitably, these lifestyle changes have led to a sharp escalation in chronic illnesses, including cardiovascular diseases, cancers and Type 2 diabetes, the impact of which is now magnified by an aging population,” said Dwyer.

Across the region, premium copays, restricting specialist access to general practitioner referrals and employee wellness programs are popular means of managing health costs.

The report identifies that private health care works best in tandem with vibrant public health systems. There is evidence that health care access, clinical outcomes and sustainable financing are all enhanced through a dual public-private health system – especially so in markets such as China, Hong Kong, Singapore, South Korea, Taiwan and Thailand.

The markets with the highest rate of medical inflation – Malaysia, Pakistan and Vietnam – are all forecasting further acceleration into 2018 and in the ensuing few years. The themes of an aging population, urbanization and chronic disease are prevalent across the region; however, there are significant variations among markets when it comes to the regulatory environment, infrastructure, health risk factors, cost drivers and cultural norms that have an impact on health care delivery and financing. As a result, the solutions to managing health care costs need to be developed at a local-market level.

EMEA Employers Prioritizing Employee Health and Wellbeing Programs

The private sector is increasingly playing an important role in public health, in large part because executives recognize that a healthy workforce is more productive. Aon’s second EMEA Health Survey revealed that 95 percent of companies see a correlation between health and employee performance. “Health and wellbeing are high on the agenda for many employers right now in the EMEA region,” said Matthew Lawrence, Chief Broking Officer, Health and Benefits, EMEA, Aon.

Accordingly, many companies have designed programs to address stress and mental-health issues, unhealthy lifestyles and physical health. Lawrence noted: “Employers increasingly recognize their role in trying to educate and improve individuals’ often poor lifestyle behaviors.”

Yet the research found that just 40 percent of EMEA companies report having a defined health strategy, suggesting that the private sector could be doing more to enhance overall employee health and productivity. The challenge is complex, however.

“While ongoing economic challenges are a given,” Lawrence said, “other factors adding to the complexity include evolving health care models, digital health technologies which transcend geographical boundaries, the changing needs and requirements of a multigenerational workforce and the desire to improve employee engagement.”

The primary obstacle for the organization is a shortage of resources: Nearly 70 percent of companies point to the lack of funding for employee health initiatives as the greatest barrier to making progress.

One way to ensure that scarce resources are allocated to programs that can make the greatest benefit is to measure their impact and show the cost savings generated, but only 12 percent of employers across the EMEA region measure the outcomes of their health programs.

These results suggest companies could be doing far more to structure, manage and measure their health and wellbeing strategies to maximize the impact – thus benefiting from a healthier workforce and cutting costs at the same time.

Prioritizing Wellbeing: A Solution to Cut Health Care Costs

Current trends in medical spending reinforce the enormousness of the societal challenge facing countries and companies. Progress will require stakeholder action on all fronts, from education to selected interventions, regulatory policy and private sector engagement. Given the scale of spending, even incremental progress to halt the growth of medical costs could have a significant impact on the health and wellbeing of populations around the world.

The post Cracking The Code Of Rising Health Costs appeared first on The One Brief.