OVERVIEW

Whether it’s the steak on your plate or the mobile device you’re reading this article on, the production processes behind it rely on a vast range of raw materials. Smartphones, for example, have at least 42 separate minerals and metals in them. And while a cut of beef may seem like the more natural commodity, cereals (such as soybeans and corn) were used to feed the cow and petrochemicals were used in the packaging.

All these raw materials and commodities face fluctuating prices that affect end consumers, businesses and global markets. And these changing prices are an inherent feature of commodities markets as they respond to shifts in global economic conditions and supply and demand.

The World Bank has credited various factors, such as extreme weather, global political instability, a rising U.S. dollar and financial markets pressures in emerging markets, as the main contributing factors of commodity price volatility in 2018.

And the markets are large: for example, the value of the global soybean market is estimated to reach more than $215.7 billion by 2025, the global iron ore market at $252.2 billion by 2024 and the global copper market at $222.0 billion by 2026.

The prices of these commodities are an integral part of business. According to Aon’s 2019 Global Risk Management Survey, commodity price risk was ranked as the number-seven global risk, with 45 percent of respondents stating they had lost income as a result. Because of this, industries from agriculture to steel manufacturing are exploring alternative ways to cope with commodity risk.

IN DEPTH

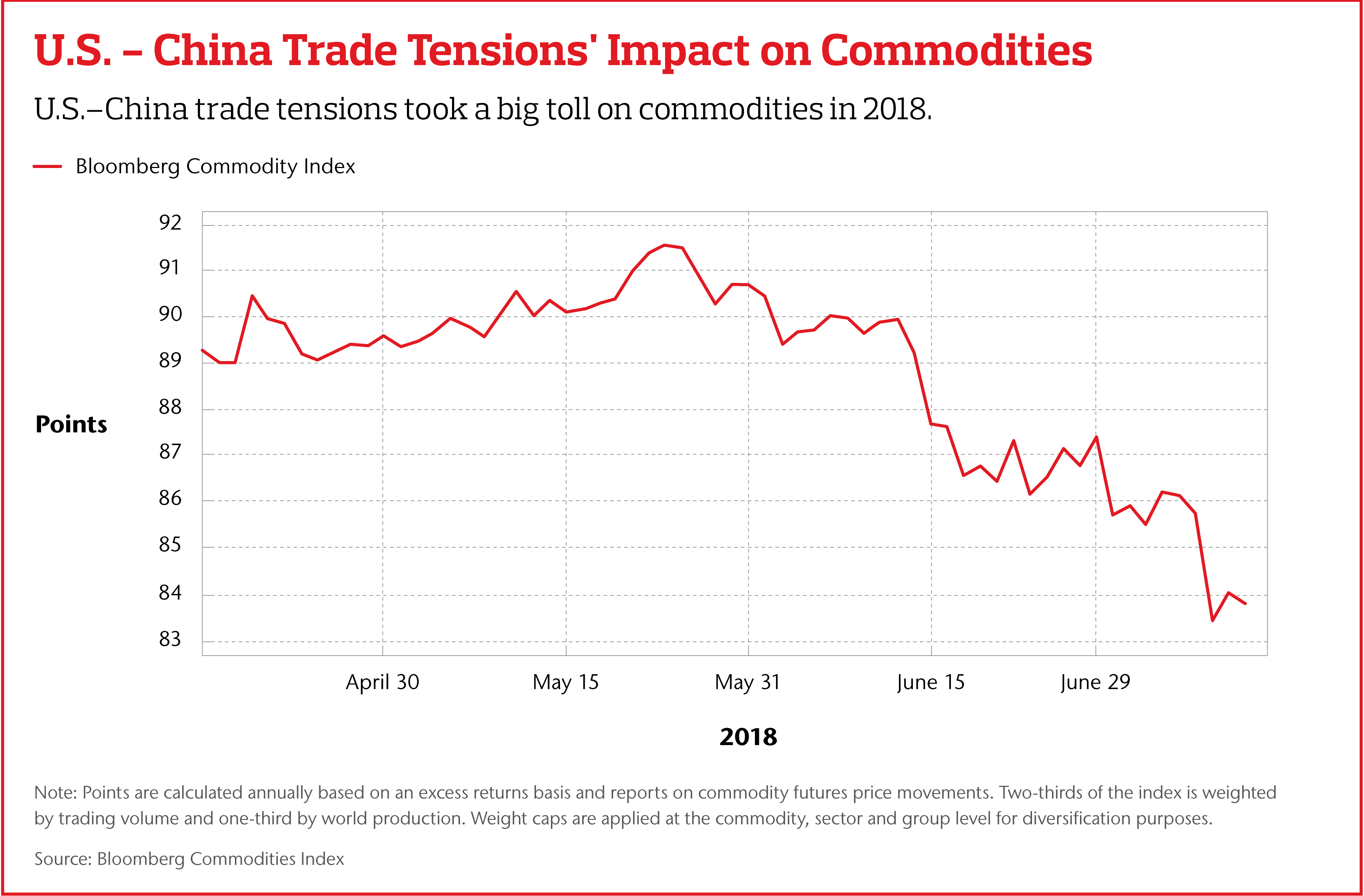

Geopolitics, such as the recent U.S./China trade tensions, have demonstrated their impact on the markets. The U.S. imposition in July 2018 of a 25 percent tariff on Chinese imports caused the Bloomberg Commodities Index, a measure of 26 raw materials, to fall 2.7 percent. This decrease is just one in a series of losses on the Index since June. The reason for the drop was due to both fears that the trade dispute prompted a broader global economic slowdown, decreasing demand and that agricultural commodities would experience reduced Chinese imports. Meanwhile, prices for soybeans and other agricultural products fell to their lowest level in almost a decade.

It wasn’t just the food and agriculture industries that felt the tariff’s impact. With China as the world’s largest consumer of copper, prices of the metal dived to a nearly one-year low. And other metal and energy markets responded to fears that the trade dispute might lead to a global economic slowdown.

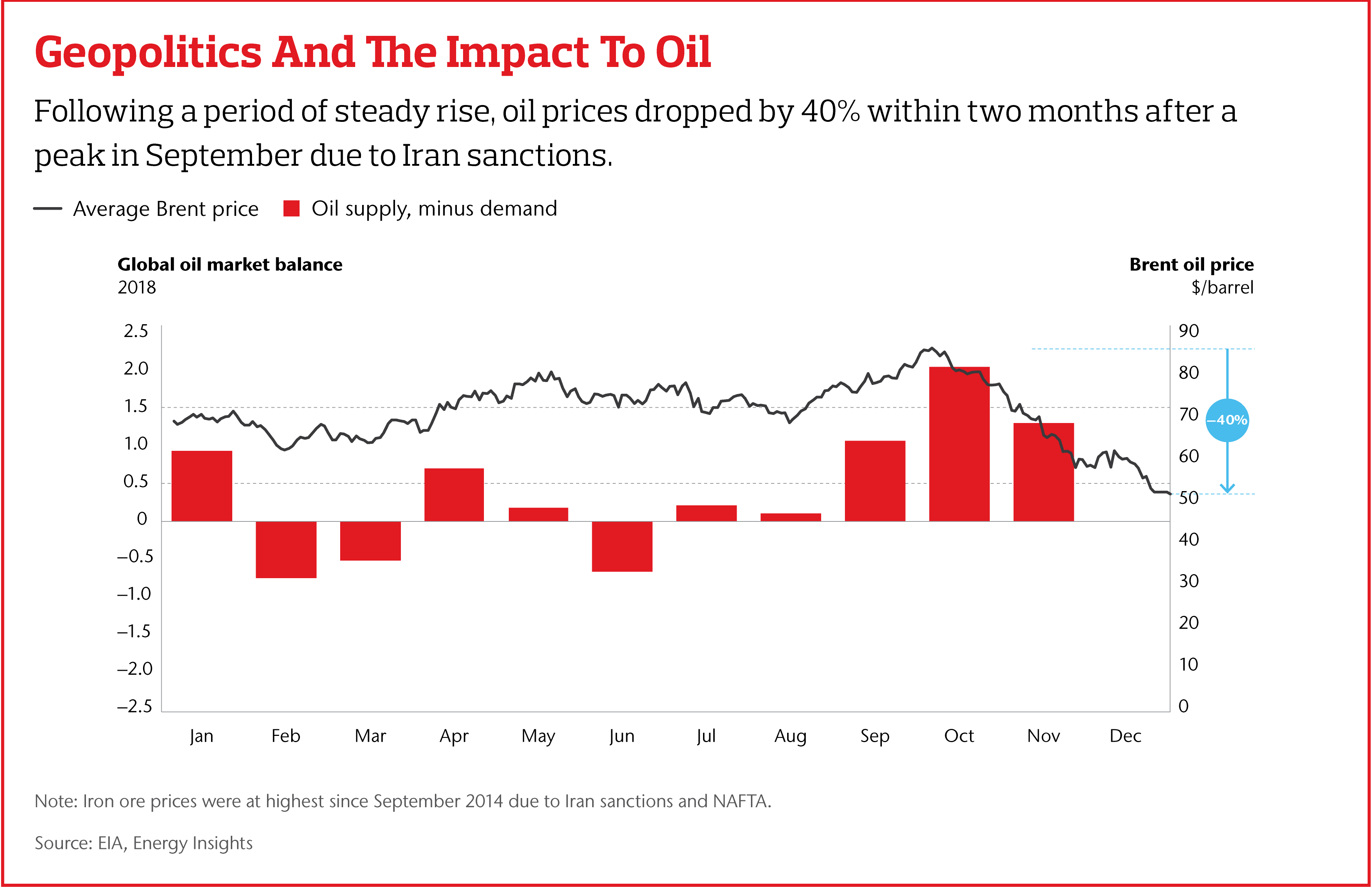

For example, oil market volatility escalated in the second half of 2018, spurred by various geopolitical events, including the U.S. imposing sanctions on Iran.

Various Factors Can Impact Commodity Pricing

The food and agriculture sector is another example of the impact of fluctuating commodity prices. In recent years the sector in the U.S. has faced reduced prices for a number of commodities, including corn, soy, meat and dairy. The price pressure has increased recently because of the trade tensions between the U.S. and China.

In addition to geopolitics, these industries are also greatly reliant on weather for crop production. An exceptionally rainy spring in the midwestern U.S., for example, has delayed planting and put the year’s grain yields in doubt for many farmers. In early June 2019, less than half the normal amount of corn had been planted in Illinois. “We’re in unprecedented territory related to crop production,” notes Tami Griffin, national practice leader, Food, Agribusiness & Beverage at Aon. “This has both short- and long-term impacts to the overall food market and overall supply and demand – which affects pricing.”

A longer-term commodity risk for U.S. farmers resulting from the current geopolitical climate is the possibility of losing markets in the months and years to come as China looks outside the U.S. for alternative growers. Griffin notes that this type of movement away from U.S. producers could make it more difficult for U.S. farmers to regain Chinese market share even after tariffs are lifted.

Prices for iron ore, an essential component of the steelmaking process, are surging. Multiple factors – both on the supply and demand sides – are contributing to the increase in iron ore prices, which reached their highest level since 2014.

A fatal dam disaster at a Brazilian ore mining site in January 2019 affected supply. Meanwhile, record steel production in China increased demand, while existing iron ore stockpiles in the country were down.

In June, a major Asian steelmaker indicated it was going to pass the increased iron ore costs on to its customers. Other steelmakers have since followed suit. Meanwhile, some are also considering how they source their iron ore, weighing the advantages of acquiring mines to provide needed iron ore rather than bidding for the raw material on open markets.

Hedging Against Commodity Risk

Commodity prices and overall market volatility may be an inherent risk to many businesses that rely on these types of goods, but there are tools for managing them, such as financial hedges. Commodity risks can also be considered as part of long-term business strategy, evaluating whether there might be opportunities for developing new markets or new supplier strategies.

For the food industry, commodity price risk is a fact of life – respondents to Aon’s Global Risk Management Survey from food, agriculture and beverage companies noted commodity price risk as their number-one risk. “Commodity price risk is factored into pricing in the food industry,” Griffin says. “Most food companies are doing some type of hedging to manage the risk.”

Many farmers or food producers reliant on commodities can purchase insurance to cover themselves against losses due to extreme weather events or unusually poor yields. For example, Australian agribusiness company GrainCorp used a derivative contract to secure protection against certain drought conditions or other severe weather events that could cause fluctuations in crop supply.

Other businesses reliant on commodities, such as carmakers, utilities or airlines, commonly use futures contracts as a tool to manage their commodity risks.

The Importance Of Long-Term Strategies

Whether businesses are commodity producers or simply in an industry dependent upon on them, they should look to long-term strategies to mitigate the impact of commodity volatility.

External events beyond an organization’s control can act as forcing mechanisms for business leaders to diversify, notes Griffin. “From understanding the impact of fluctuating prices over time, analyzing supply chains and exploring other markets, organizations can better prepare for uncertainty.”

The post Shock And Ore: Doing Business In The Face of Volatile Commodity Markets appeared first on The One Brief.